How Often Can You Increase Credit Card Limit

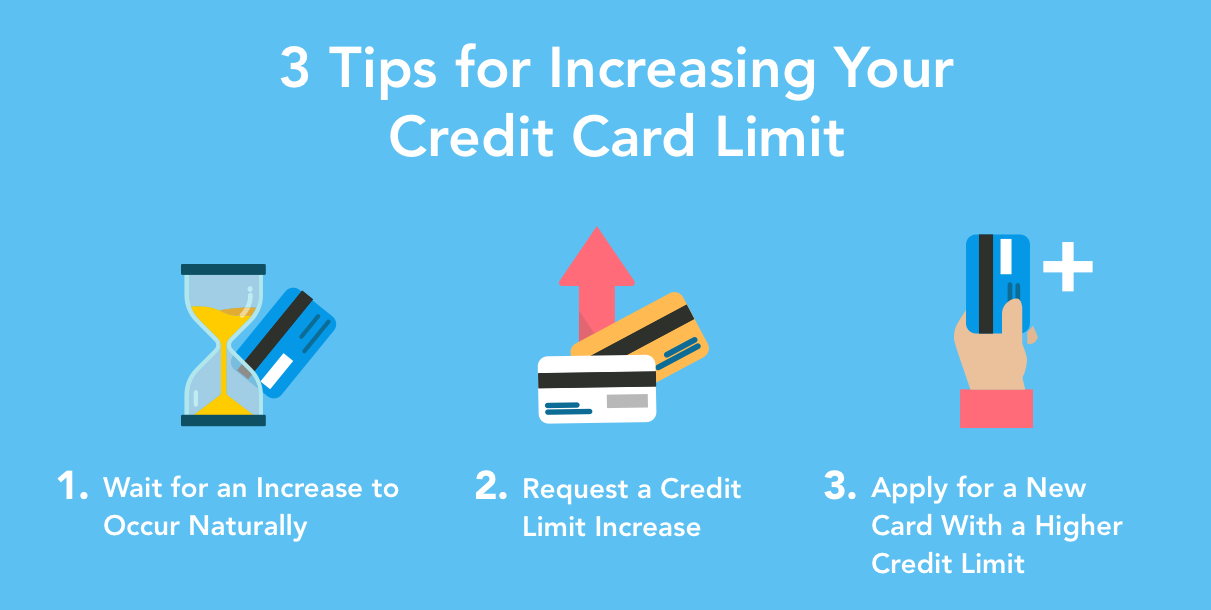

But if the amount you receive isnt enough you could consider requesting an increase after a few months of responsible credit card use. After youve been a cardholder for a minimum of six months to one year some issuers will automatically increase your credit limit if they feel you are a low credit risk.

When Should I Ask For A Credit Limit Increase Nerdwallet

If youve ever logged into your card account or opened your cards app and seen a pop-up screen requesting income information it could mean your card issuer is considering a credit limit increase.

How often can you increase credit card limit. As you make payments on time maintain a healthy credit utilization debt-to-limit ratio and perhaps increase your income level you may become eligible for a credit limit increase. Unfortunately you cant request a specific credit line amount when you apply for a new card. As soon as you receive and activate your credit card you can request a credit limit increase.

You can request either an increase or a decrease in your credit limit just tell us what youd like your credit limit to be and well do our best to accommodate your request. If you were approved for a credit limit increase you can try to request another increase six months later but note that getting approved for a second credit limit increase is often more difficult the second time around. Issuers will generally offer you a credit line increase periodically without you having to ask for it.

While the Apple Cards financial health help page says you can request a credit limit increase after as little as four months other Apple Card documentation mentions establishing credit history for six months or more before you apply. But note that often banks dont approve you for a credit limit increase until after youve used their cards for several months. Every time you charge an item on your card you increase your credit utilization ratethe percentage of your available credit that youre using.

Follow the given tips and sample request letter to increase the credit limit. If cash app cant verify your id it might require additional information. For example if you have an American Express card you can request a credit limit increase once your account has been open for at least 60 days.

To show that youre a responsible borrower and receive a potential limit increase you should. If you plan to call or chat online with customer service be sure to prepare yourself with some tips beforehand. If youve made all of your payments on time and never maxed out your card youre more likely to get approved for a limit increase.

Your credit utilization rate is one factor in your credit score and your goal should be to keep the rate no higher than 30 percent. How often can you request a credit limit increase. Credit card issuers may review your credit file and account every six to 12 months and may offer you a credit line increase when they do.

My other Comenity cards increase with the luv button every month but I dont want to push them if it definitely wont happen. How to increase your credit limit without hurting your score. Having a high credit limit can positively affect your credit score and can increase your spending power.

They did approve the increase so I went from 800 to 1269 and once I saw the new limit post on the account I took the item back. Sometimes your card issuer will offer to increase your credit limit after youve consistently demonstrated that you use the card responsibly. And if you have a Capital One card you generally arent eligible for a credit line increase if you opened your account within the past several months.

Wait at least six months between requests for a credit limit increase. As a rule of thumb its best to keep your credit utilization ratio below 30. Cardholders are generally eligible for Amazon Store Card credit limit increases after 6 months of on-time payments but that doesnt mean you will necessarily be granted one.

The credit limit can be increased in multiples of 25 at a time. And each of these many cards can get a credit limit increase if you know how and how. Late payments and high credit utilization can suggest someone.

How much of my credit limit should I use. While getting a credit limit increase is not guaranteed following these tips can help you prove your creditworthiness and make your case when you contact your issuer. The credit limit increase will be secured by money from your Credit Builder Account the same as when you opened the credit card.

You can request a change to your current credit limit within Barclaycard online servicing by selecting Change credit limit and following the instructions on-screen. How often does PayPal Credit increase the limit when doing it this way. If you demonstrate that youre a responsible credit card user and use the card enough to warrant a credit limit increase you could get a higher credit line as frequently as every 6 or 12 months.

You can ask for a credit limit increase as many times as youd like but the more often you ask the less likely you are to get your increase approved. How often can I get credit limit increases. Cash app fees can often be avoided by choosing the slower option and by never paying by credit card.

Read on to find out how to maximize your chances of. Navy Federal may also extend you an automatic credit limit increase as often as once every six months but probably not so frequently. Citi also offers a strong line of its own-brand plastics so the bank has a strong presence in the market.

Waiting a few months between requests could help improve your chances. Many credit card companies increase your credit limit automatically without you having to lift a finger. The evaluation for an automatic increase uses a soft credit pull which does not affect your credit score.

This includes making on-time payments and paying your balanceall while using the card frequently. If you ask for a higher credit line more often your issuer might consider it a sign of financial distress. Make all your repayments on time every month and - if you can - in full Never spend beyond your current credit limit If youre eligible for a limit increase youll be.

How to increase cash app limit. If you dont see the credit limit increase alert in your account dashboard you may not be eligible yet. 1 In fact showing youre a responsible card user can lead to a credit card limit increase as often as once every six to 12.

More often than not a higher credit limit means a lower credit utilization ratio and that can improve your overall credit score. Getting an Automatic Increase You may not have to do anything at all to get a credit limit increase.

How To Increase Credit Limit It S Easier Than You Think

How To Increase Credit Limit It S Easier Than You Think

3 Easy Tips How To Increase Credit Card Limit Mintlife Blog

How To Increase Credit Limit It S Easier Than You Think

Posting Komentar untuk "How Often Can You Increase Credit Card Limit"