How Often Do Tesco Credit Card Increase Limit

They could even change your limit if your credit score takes a big dip or you dont use the card often. It was hurriedly increased to 45 last year as the.

Tesco Foundation Credit Card Review 2021 27 5 Apr Finder Uk

Some providers will also let you turn off contactless completely.

How often do tesco credit card increase limit. Credit card companies can cut credit limits without warning if they think you may have trouble paying off the balance. Were please to let you know that the credit limit on your Tesco Bank Credit Card is being increased from 2100 to 5100. Learn what to do if your credit limit is lowered.

Choose a monthly repayment date that suits you and change it up to twice a year. Your credit limit has changed in the last 10 months increase or decrease Youve had your credit card for less than 6 months. You can do this by spending less on your card or getting a higher limit.

Standard network charges may apply. As a rule of thumb its best to keep your credit utilization ratio below 30. And if you have a Capital One card you generally arent eligible for a credit line increase if you opened your account within the past several months.

Do Card Issuers Increase Your Credit Limit Automatically. For example if you have an American Express card you can request a credit limit increase once your account has been open for at least 60 days. Heres what you need to know.

Representative 349 APR variable Based on assumed borrowing of 1200. The outstanding balance in your account that rolls over from one month to the next attracts interest and an increased credit limit can work in increasing the outstanding balance resulting in you paying more in the form of interest. Should you want to decline the change call 03456 062 062.

You could get a credit limit increase after three months. If you demonstrate that youre a responsible credit card user and use the card enough to warrant a credit limit increase you could get a higher credit line as frequently as every 6 or 12 months. Up to 56 days free credit.

We may set a credit limit on your account until you have established a good payment history with us or if you fail to pay your account on time. So for a healthy credit score try to use no more than 25 of your credit limit each month. Well send you a statement every month to let you.

The limit was raised gradually to 15 in 2010 to 20 in 2012 and then to 30 in 2015. Credit card issuers may review your credit file and account every six to 12 months and may offer you a. If you dont pay your accounts balance in full every month a credit limit increase might not be a good option.

When you are eligible to have your limit reviewed then phone up and ask what can be offered depending on the way the account had been run and other criteria you will be given an offer which you can either accept in which case it will be a futher 6 months before you can increse the limit further or you can decline in which case you can request. Waiting a few months between requests could help improve your chances. Well automatically increase your credit limit on 12th August 2015.

The contactless card payment limit is rising from 45 to 100 on 15 October. The interest rate for borrowing that at least 51 of the customers accepted will pay. By requesting a credit limit increase you are authorising us to review your credit history and any other relevant information required to process your request.

From time to time we may write to you offering a credit limit increase. You can increase your odds of getting an automatic credit limit increase by. Although your bank can increase your credit limit its totally up to you if youd like to change it back.

Youll not be eligible for a credit limit increase if. How much of my credit limit should I use. Review the information displayed and select Confirm.

We dont charge any monthly fees late fees over-limit fees or international transaction fees. If this happens we will give you 30 days notice before any change will take effect. It can be quite frustrating to receive news that your request for a credit limit increase has been denied.

Credit Limit to suit you You can request an increase in your credit limit using AIB Internet Banking Subject to lending criteria Spread your repayments With an AIB CLICK Visa Card you decide how much you want to repay from the minimum amount 3 or 635 whichever is greater to the full outstanding balance. Log on using biometrics or your Digital Secure Key. After all rejection of any kind is.

Whether rewards are paid on your spending with the credit card. The annual interest rate youll pay on new purchases after the interest-free deal ends. But Bank of Scotland Danske Bank UK Halifax Lloyds and Starling will let you set your own limit and others plan to do the same in future.

In the meantime just dont exceed your existing limit or you may be charged. If you go over your credit limit andor miss repayments your bank might lower your credit card limit without asking you. Go to Credit limit increase.

Tesco has never increased my limit yet I have used all the cards similarly in that sometimes I have used for purchases and pay off the balance in full every month other times I. Lines are open 8am - 10pm Monday - Friday and 8am - 6pm Saturday and Sunday. If you use your card youll need to make a payment every month even if you are on a 0 interest rate.

Enter your new limit request and answer the questions. You can ask for a credit limit increase as many times as youd like but the more often you ask the less likely you are to get your increase approved. Select the card you want to request the limit increase for.

For example if you shifted a balance of 1000 from a card with a limit of 2000 to a new card with a 4000 limit the amount youre using would change from 50 of your. The default credit limit value is 50 and we may increase decrease or remove your credit limit without notice. Tesco IME dont give very high limits compared to other cards eg Sainsburys American Express keep sending letters increasing limit to ridiculous amounts approximately 15K I think.

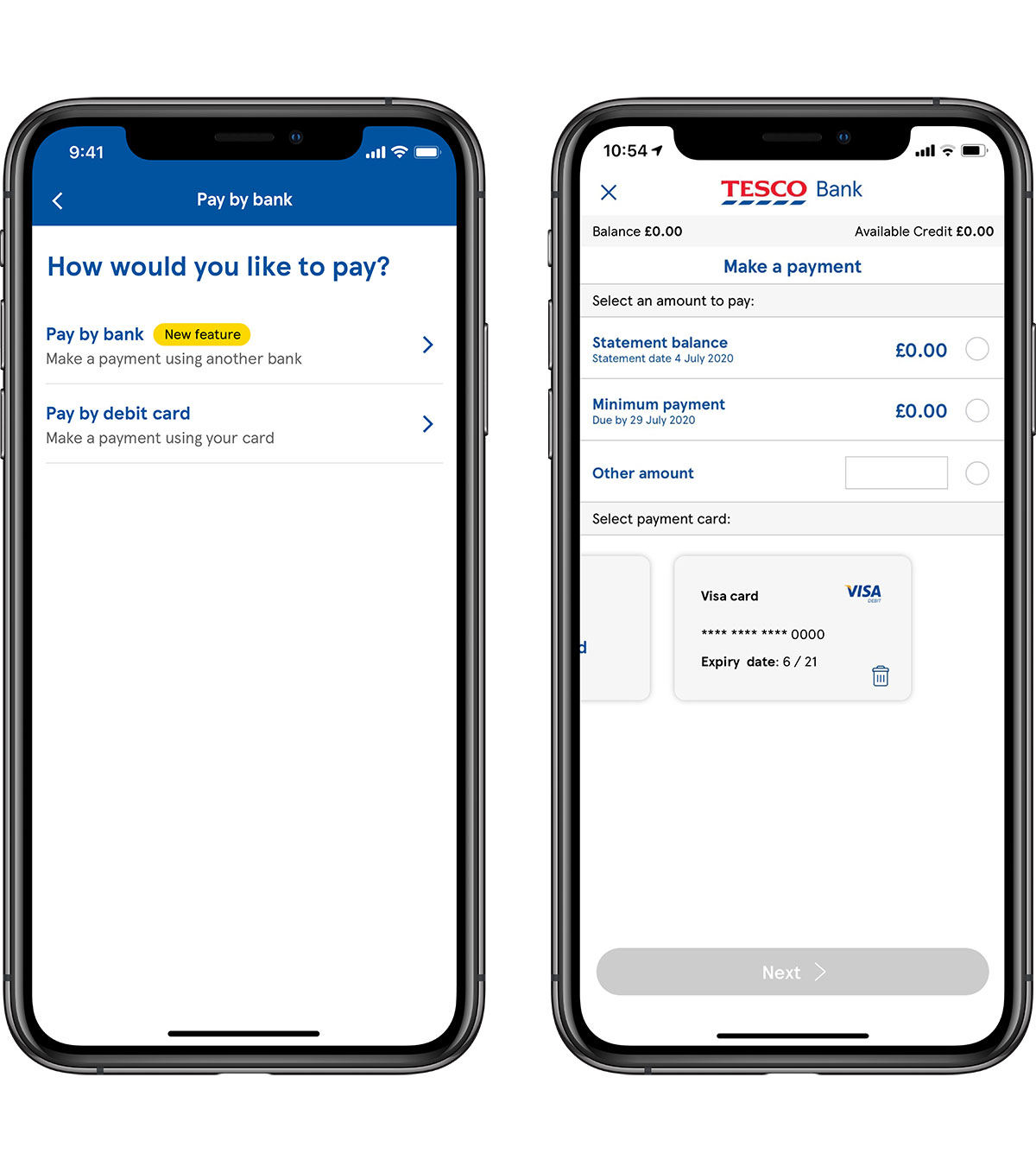

Managing Credit Cards In The Mobile Banking App Tesco Bank

Tesco Bank To Increase Minimum Payments For 125 000 Credit Card Customers

Managing Credit Cards In The Mobile Banking App Tesco Bank

Managing Credit Cards In The Mobile Banking App Tesco Bank

Posting Komentar untuk "How Often Do Tesco Credit Card Increase Limit"