How Much Should I Ask To Increase My Credit Limit

Once youve got that you can just call them at 1-800-347-9700 to request a credit limit increase. An increase in income means youll be able to cover an increase in credit card expenses.

Why And How To Request A Credit Limit Increase Money Under 30

Personally Im not at all comfortable using even 25 of my credit lines and certainly not more than 25 on one card Having more credit doesnt hurt you unless you use it irresponsibly.

How much should i ask to increase my credit limit. For example youll generally want to keep your credit utilization between 20 and 30 of your available credit. When youre approved for a credit card your card issuer will assign you a credit limit. Raising your credit limit decreases your utilization ratio if your balances remain the same.

First off you should make sure you got some history with it at least six months. If you are still charging 800 each month then your credit utilization is now 16. Clarissa Motos Member clarissa_motos 042018.

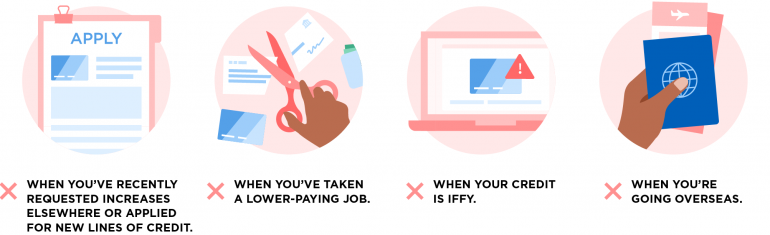

As a result you should make sure to ask for smaller credit limit increases. How much should I ask for Chase is HP and if you can take the HP I would call directly into backdoor and try to do it with Rep while on phone if they have any questions. If youve kept the balance low and made your payments consistently youre in a good place to request a credit limit increase.

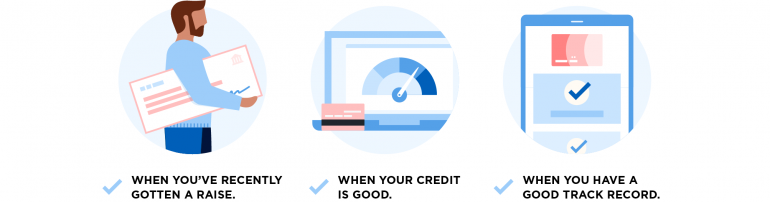

But whether or not youll be able to get approved for a higher credit. Timing a Credit Line Increase Request. In much of life timing is everything.

How much of a credit limit increase should you ask for. At the same time you dont want to ask for too much or seem too confident. However you can request for increases that are way higher than that.

Theres no one-size-fits-all answer to how much of a credit limit increase you should request. One factor to consider is that the representative may only be able to increase your credit limit a small amount based only on your account history. The worst that would likely happen is when applying for a mortgage or other line of credit a bank may ask you to lower or close a large line.

If you were to increase your credit limit to 12500 and still had a. If your limit increased to 4000 your utilization ratio would drop to 25. Its usually pretty reasonable to request for your credit limit to be increased by 50 to 100 depending on how high your starting credit limit is.

A card issuer cant charge an over-limit fee unless youve agreed to permit over-limit charges on your card. If its a rewards card so much the better. There are reports of people starting with credit limits at 1200 and then receiving increases all they way up to 20000.

Photo by Natee MeepianEyeEmGetty Images There are multiple aspects to consider when deciding how much of a credit limit increase to request. In credit this is particularly true. If you are at 6k 12-15k would be where I would be asking.

When should I ask for a credit limit increase. Keeping it to 10 or lower is even better. Instead ask for 10 to 25 more up to y 1000 in credit you already have.

How much should I ask for credit limit increase. Keeping your credit utilization under 30 helps prevent credit card balances from bringing down your score. Policies for credit limit increases differ from issuer to issuer.

Now lets assume that you asked for a credit limit increase and now have a maximum of 5000. Technically you could apply for a higher credit limit online or call your card issuer to ask for one directly as often as you like. When something positive happens specifically income related.

Using only a portion of the credit available shows. This amount can be anywhere from a couple hundred dollars to. By increasing your limit you can improve your utilisation ratio which can improve your credit score.

Also obviously make sure that period of time is clean with no late payments or even maxing out your limit. Some card issuers may allow charges that exceed your credit limit but they typically charge an over-limit fee of up to 25 the first time you go over your limit and up to 35 if you do it again within six months. For one the First Premier Bankcard charges 25 of the increase each time youre approved for a credit limit increase.

At Capital One for example accounts that have only been open a few months are generally too new to be considered. If the bank cant approve you for limit that high usually theyll counter and you might end up at 5000. Can you raise my limit.

When exactly you should ask for a credit limit increase is up to you. If you have a similar card forego requesting a credit limit increase and instead move to a better credit card as soon as you qualify. If so you can leverage that extra income to qualify for a larger credit limit.

And it depends on your own unique circumstances. You may need to provide proof of your. For example dont insist the rep double your credit limit.

Some are generous with extending credit some are not. You can say Id really like to take greater advantage of your great rewards program but Im concerned about my utilization ratio getting too high. Larger credit limit increases on the other hand will likely require a hard inquiry on your credit report.

If you increased your credit cards limit from 1000 to 2000 and left your 600 balance untouched your utilization would drop from 60 to. Your utilisation ratio is the percentage of credit youve spent against your overall available credit limit you should aim to use only 25 of the credit available to you where possible. If youd like a card with a higher limit I suggest applying for a Chase or Amex card.

Citi should be soft and do it right online. 4 Its worth noting that this card caters to people with bad credit. Recent Pay Raise Did you recently get a pay raise or promotion at work.

If you have excellent or even good credit you may be able to ask for more. Credit unions vary a lot when it comes to handling credit increase requests. Say that you want to keep your credit utilization ratio below 30 but that youd like to use the card more.

For example you should be able to get a 10 to 25 percent increase on your credit limit so long as your finances can support it but a doubling of your credit limit is extremely unlikely barring rare and unusual circumstances. There are two ways to lower this ratio paying down your balance or increasing your limit.

When Should I Ask For A Credit Limit Increase Nerdwallet

When Should I Ask For A Credit Limit Increase Nerdwallet

How To Increase Credit Limit It S Easier Than You Think

How To Increase Credit Limit It S Easier Than You Think

Posting Komentar untuk "How Much Should I Ask To Increase My Credit Limit"