Is It Bad To Increase Credit Card Limit

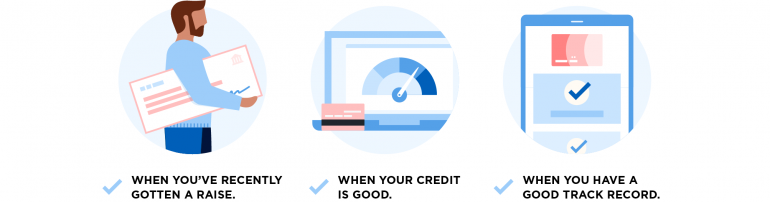

There are a few ways to get a higher credit limit. Over time when you use your credit card responsibly your credit score may begin to climb and your credit limit can increase Capital One says.

6 Expert Tips Increase Your Credit Limit Get Approved Now Cardrates Com

While an increased limit can potentially improve your credit score its probably better to keep your available credit low to prevent further debt.

Is it bad to increase credit card limit. Sometimes it doesnt require any action from you. Youll usually have a better chance of getting the limit increased after youve had the card for a reasonable length of time. Increasing a credit card limit lowers your credit utilization ratio which boosts your credit score.

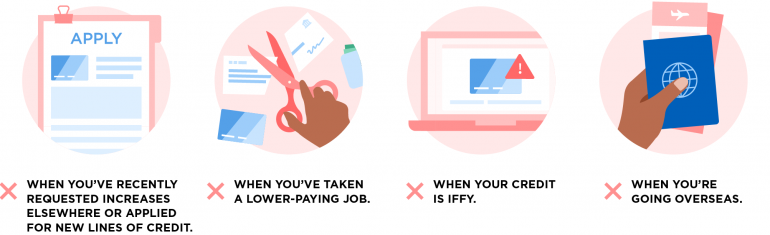

If you have credit card debt or a problem controlling your spending accessing more credit may be a bad idea. A higher credit limit can lead to more debt if not used responsibly. How to request a higher credit limit.

Some credit card issuers regularly consider cardholders for an automatic credit limit increase. Luckily automatic increases wont generate a hard inquiry on your credit report as you must agree to those beforehand. If you increased your credit cards limit from 1000 to 2000 and left your 600 balance untouched your utilization would drop from 60 to.

There are two ways to lower this ratio paying. A hard pull on your credit report. The only problem with this is some 0 balance transfer deals require you to shift the debt within the first 60 or 90 days or so to be eligible to get the 0 deal so it may be too late for that.

An increased credit limit bring greater spending flexibility and its also something of a vote of confidence by the bank in regard to your credit history. Your account may be too new it may be too soon since the last change in your credit limit your income may be too low to qualify you for an increase or you may have an account that doesnt receive credit limit increases such as a secured credit card account. If a higher limit might lead you to spend more requesting a credit limit increase might not be a good idea.

On-time payments debt to credit ratio etc. Luckily you can lower your credit utilization by increasing the amount of credit to which you have access. It can be a better choice than taking out a.

Increasing your credit limits is a good way to blunt the effect credit card debt can have on your credit scores. Asking the bank to raise your credit limit isnt always a bad moveunless your only intention is to splurge on things you cant afford. So getting a credit limit increase can positively affect this aspect of your credit score.

If you dont use the card often you likely wont be offered a credit limit increase. If the extra capacity to spend money is there the temptation may be irresistible. But youre probably starting with a small limit you wont get to a very high limit within the next several years at least.

The worst that would likely happen is when applying for a mortgage or other line of credit a bank may ask you to lower or close a large line. Youre not alone in thinking that a credit limit increase can hurt your score and make it harder to get a mortgage. In my experience with all my credit cards whenever I ask for a line of credit increase the bank evaluates only my relationship with them ie.

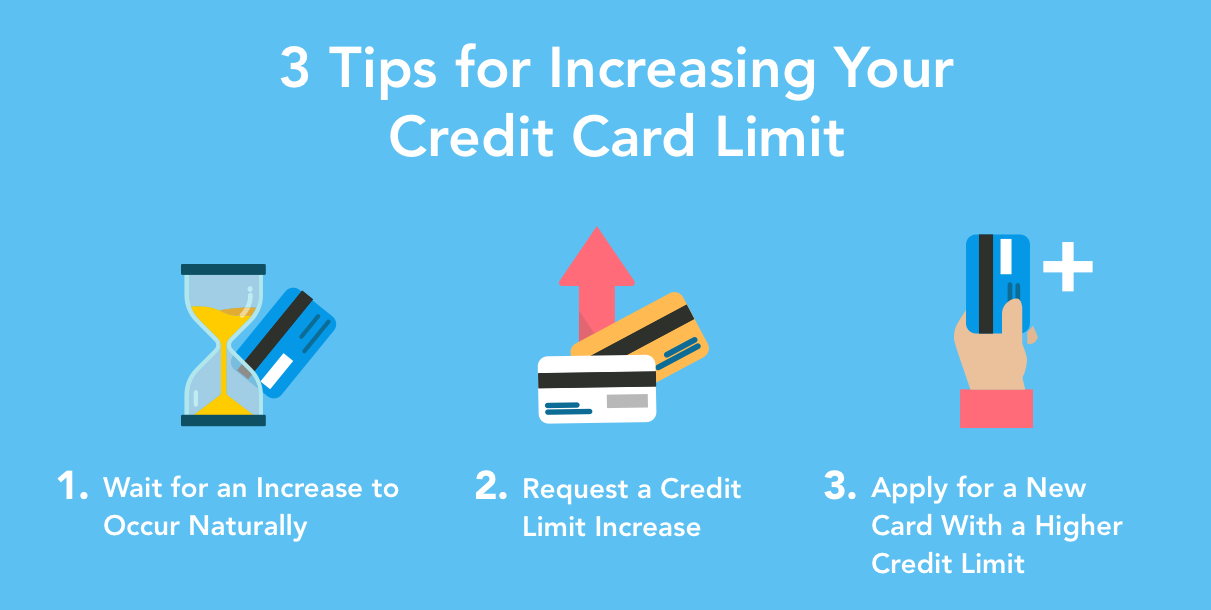

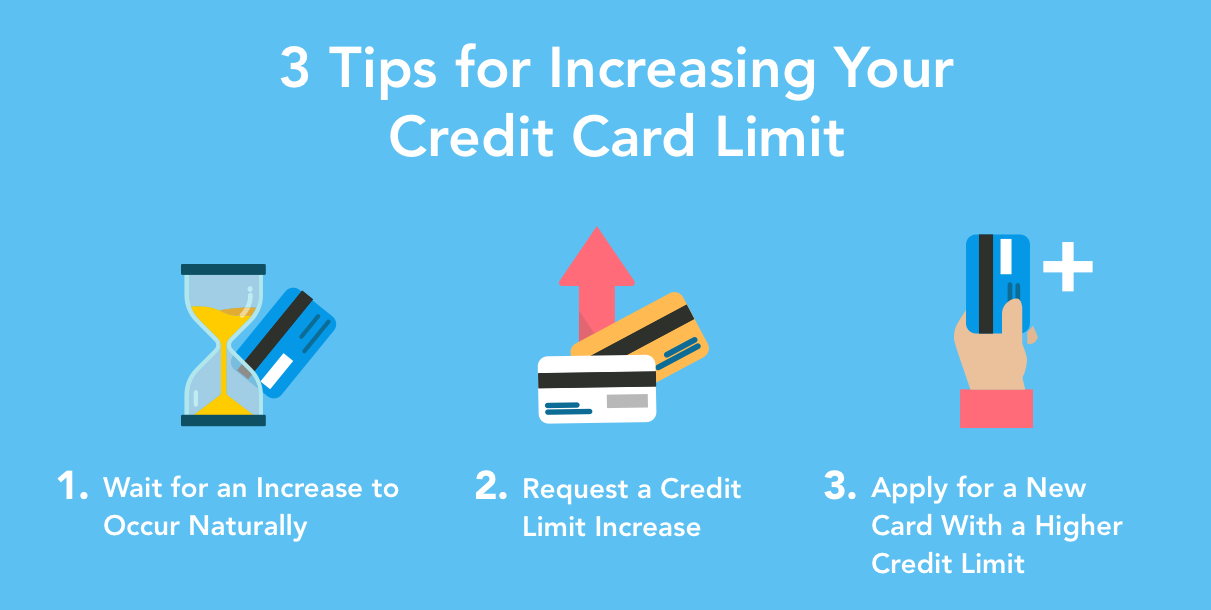

New credit accounts for. Yet there are many more aspects to be aware of when it comes to an increase in your credit card limit so you can reap the benefits and avoid the downsides. Request a Credit Limit Increase Dont want to wait for your card issuer to increase your credit limit or not on its own.

As for the bad news it is surprisingly modest. So if you have a credit limit of 10000 and a balance of 3500 your credit utilization is 35. Asking your credit card issuer to increase your credit limit can not only boost your buying power but also lower your credit utilization which could help your credit scores.

Years ago the common wisdom was that the more credit you had available the riskier the borrower. An expanded credit limit lets you use your credit card to make larger purchases finance more necessities weather more emergenciesall without causing your credit utilization to climb too high. Alternatively you can ask for a higher credit line by contacting your bank.

Be sure to follow the number one rule of responsible credit card spending and only make purchases youll be able to pay off in full by the end of your grace period. The initial review period is often around three to six months. Discover Discover doesnt disclose its criteria for CLIs on its website but it does offer some general information about how card issuers determine card limits.

This post was updated on March 25 2021. One caveat some issuers do a manual review for credit line increases. A credit card limit increase boosts your spending power which is extremely helpful in preparing for the unexpected like a financial emergency or a crisis like the current COVID-19 pandemic.

A credit limit increase will most likely help your credit score assuming you dont go on a spending spree with it. Your credit limit increase may be denied for a few different reasons. All that said increasing your credit limits wont necessarily help your credit scores if you wind up increasing your card balances as well.

If your request is refused and you get no increase the effect of a hard pull should be only a few points and shouldnt have an effect on your score. Benefits and drawbacks to requesting a credit card limit increase A larger credit line may allow for more flexibility when it comes to your spending power but this isnt always a good thing. As a result a request does not generate a hard credit pull and does not impact my credit score - even if the request was declined.

What Credit Limit Will I Get When I Apply For A Credit Card

When Should I Ask For A Credit Limit Increase Nerdwallet

When Should I Ask For A Credit Limit Increase Nerdwallet

3 Easy Tips How To Increase Credit Card Limit Mintlife Blog

Posting Komentar untuk "Is It Bad To Increase Credit Card Limit"