How To Print Ea Form From Lhdn

To prepare EA forms to print for employees e-Filing you can refer to the guide below or follow these steps. Most of the Income Tax related forms are available at this website.

Understanding Lhdn Form Ea Form E And Form Cp8d

Details for ALL employees remuneration matters to be included in the CP8D.

How to print ea form from lhdn. Form E Borang E is required to be submitted by every employer companyenterprisepartnership to LHDN Inland Revenue Board IRB every year not later than 31 March. To prepare EA forms to print for employees e-Filing you can refer to the guide below or follow these steps. Head over to Payroll Payroll Settings EA.

In Swingvy payroll software you can choose either to send an email to your employees or download your employee EA form to print out hard copy. To prepare Form E to print for e-Filing you can refer to the guide below or follow these steps. The number will start with E xxxxxxx-xx.

Double check all the EA forms to ensure that everything is in place. However there are several reasons why you shouldnt accept the annual income stated on your EA form as the final figure for your statutory income from employment. Recently i recieve a letter said that i need to pay for tax which i already submit last year.

Print Form Draft button Print form in PDF format. Once that is done click on Download EA Forms sign and pass them to your employees. Click on Generate EA for 2020.

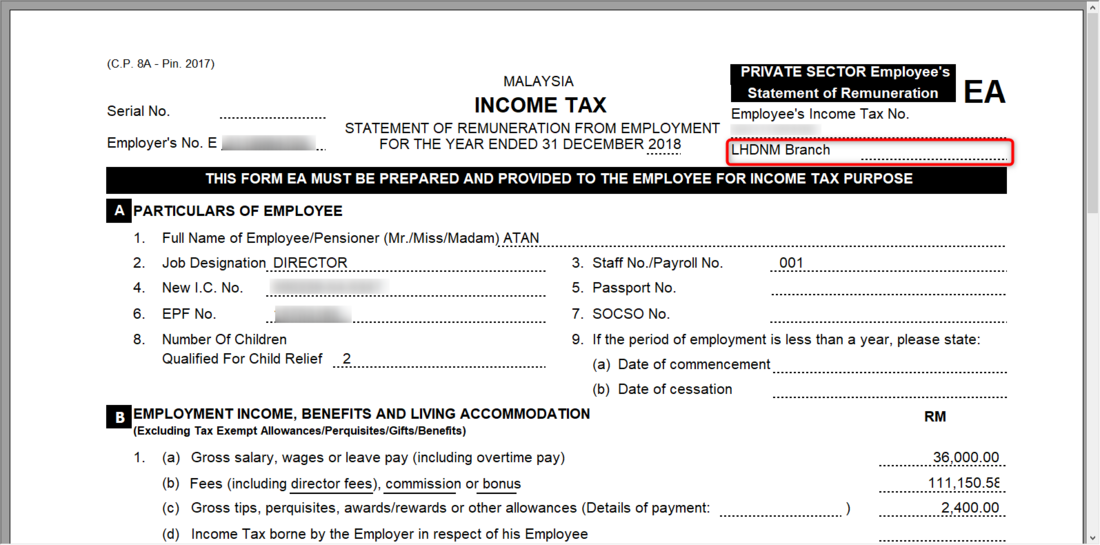

It is the Statement of Remuneration from Employment Private Sector. Once that is done click on Download EA Forms sign and pass them to your employees. The EA form has to be prepared by employers in Malaysia and given to the employees for income tax purposes.

Head over to Payroll Payroll Settings Form E. You need this number when you file your Form E. 2017 EA Forms Download links.

Go to Reports and print EA Form and E Form To have finer detail in EA Form for allowances as shown below you need to import allowances separately The Excel import template has space for 15 allowances 10 deductions and 5 Benefit in Kind. EA - Remuneration Statement for Private Employees. Watch the video below for a quick guided walkthrough to get your Form EA in less than a minute.

If you export EA Form as HRmy Administrator these 2 fields will be left empty. When the EA Forms are shared with employees they can download EA Form Excel format via Team Document Form Sharing in their Web Accounts. Ianya hanya perlu diserahkan kepada pekerja.

How to generate Form EA in Swingvy. 2017 is the latest version available for download at LHDN website. Sign screen will be displayed as below.

Form E used to be summary of EA Forms. LHDN Borang EA EA Form Malaysia According to the Inland Revenue Board of Malaysia an EA form Malaysia also refer to Borang EA EA Statement EA Employee is an Annual Remuneration Statement that every employer shall prepare and render to his employee statement of remuneration of that employee before 1st March in the year immediately following the first. Login as usual.

THIS FORM EA MUST BE PREPARED AND PROVIDED TO THE EMPLOYEE FOR INCOME TAX PURPOSE A B C E CONTRIBUTIONS PAID BY EMPLOYEE TO APPROVED PARTICULARS OF EMPLOYEE EMPLOYMENT INCOME BENEFITS AND LIVING ACCOMMODATION Excluding Tax Exempt AllowancesPerquisitesGiftsBenefits RM PENSION AND OTHERS TOTAL. Use the file start with P to submit. IRBM LHDN will not accept and entertain any companies who submit their Form E via hand and postal delivery.

Any1 can tell me how to trace back my previous e-filing from wwwhasilgovmy. Download EA Form Inland Revenue Board Of Malaysia. The website is httpsezhasilgovmyCI - we attach a few screenshots here to make your life easier.

There will be a form to fill in and documents to be submitted to LHDN. Click on Sign and Submit button to submit your e-Form. Double check all the EA forms to ensure that everything is in place.

Back button To return to previous screen. Part F is where you can file for tax exemptions on certain perquisites and benefits-in-kind thereby reducing your overall chargeable income. Head over to Payroll Payroll Settings EA.

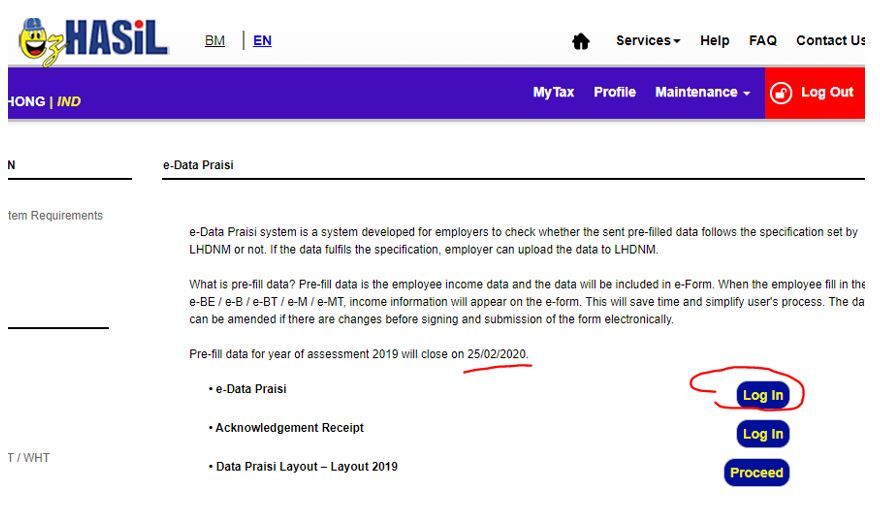

LHDN will open the actual Form E submission CP8D at 1 Mar 2021 it should be very straightforward and work exactly like last year. 4 minutes Its tax filing season and time to file for tax exemptions in Part F of Form EAAfter all you do not want to overpay your taxes. By 25 Feb 2021 you are encouraged by LHDN to submit the E-data Praisi.

The latest version of the EA form 2020 is. You may downloadprint your receipt here. Borang EAEC tidak perlu dikemukakan kepada LHDNM.

Generating Form EA in Swingvy takes a few clicks to get it out to your employees. You need this number to pay PCB. In case if you do not receive it Form EAEC can be downloaded here.

Total PCB deductions also stated in payslip add the total deductions for the current. For prev employer its on the EA form. This is where your EA form comes into play as it states your annual income earned from your employer.

Hahah I just did this last week. Forms to be used. I dont know where to askso i ask here.

At Declaration screen you are able to. Please note that there are 2 fields at the bottom of the EA Form for Name and Job Title of the employee who prepares the EA Form. Form EA or EC is not required to be sent to IRBM.

Continue button to submit your e-Form. Sign and Submit button To submit form. Do it in Feb so they can have their tax assessment in March.

You may now send EA form to your colleagues by email or by print out the hardcopy. The above mentioned form will be attached together with Form E which is posted to you. How do I get EA form from LHDN.

Monthly salary allowance gross amountbefore deduction C3. Colin Nombor pendaftaran majikan you will need to apply from LHDN. Sekiranya syarikat tidak menerimanya Borang EAEC boleh dimuat turun melalui laman web utama dan klik pada ikon Borang.

EC - Remuneration Statement for Government Employees. EA Form 20202019 CP8A and CP8DE Form Summary and Download Links. There are no changes to EA Form 202020192018.

Now go to Payroll-Form E page download the e-Data Praisi file and unzip it. The EA form for Lembaga Hasil Dalam Negeri LHDN or the Inland Revenue Board Of Malaysia is also known as Form CP8A. The form will automatically calculate your aggregate income for you.

The following information are required to fill up the Borang E. If current employer theyll fill it up not you. Total EPF deduction can see monthly deduction your payslip- add the total for the current year C5.

Payroll How To Fill In Lhdnm Branch On Income Tax Ea Autocount Resource Center

Ea Form 2020 2019 And E Form Cp8d Guide And Download

Posting Komentar untuk "How To Print Ea Form From Lhdn"