How To Increase Transfer Limit Cba

Secure transfer method. In the CommBank app tap on the Cards icon choose your Credit card and then Credit limit.

Increase Cba Netbank Daily Limit Jewlz Ellem Tax Agent Xero Gold Partner

There is no fee for this.

How to increase transfer limit cba. The amount of the transfer will be equal to 60000 less the balance on your RBC CreditLine for Small Business on the day of the transfer. Click Payee Accounts from the right hand menu. You can initiate your transfer online or at your local Bank of America branch.

Sign on to Citibank Online and select Payments Transfers from the top menu bar options. To your own OCBCPlusJ account. To increase the daily limit to 100000 please follow the below steps.

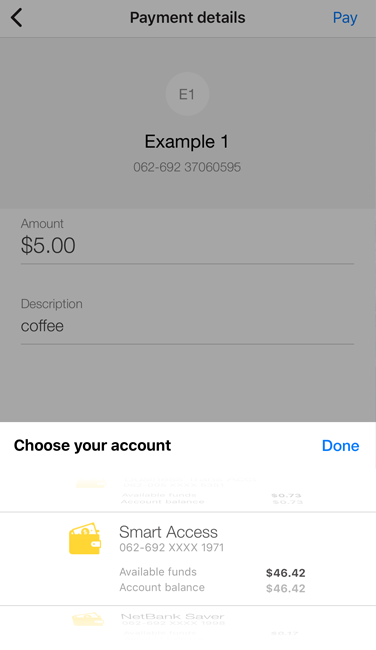

If you need you can increase your daily limit. Under Your preferences select Change Daily Payment Limit. If you need to transfer 5001 you will need to increase the daily transfer limit to a higher value.

Please note however that when you decrease your limit on a CommBank card it is permanent so increasing it again means you have to reapply and it is subject to approval. 4 NEFT to registered beneficiary per day - up to Rs10 lakhper transaction - up to Rs 5 lakh. Click on Customer service and select Card withdrawal spending limit under Cards.

Enter your new limit or slide the bar to select then. 4 Step 4 Set your limit and tap Next. To increase your daily limit above the default you will need to activate a Security Token again.

An Account Limit is a maximum that can be debited from the account per day regardless of how many registered users are listed on the account or what their individual Daily Limits are. You can apply to increase it anytime in Netbank or the CommBank app. Transfer funds Make a transfer to an account to a PayNow user Add manage payees Link or Manage PayNow Manage future-dated and recurring transfer Check internet transaction status Update transaction limits Manage e-Alerts Payments transfers Open an account Customer service Transfer Funds 1.

If all your limits are. For added security Business Accounts can also have an Account Limit. You can then set it back down to their normal options once you have finished.

Its the daily limit for all your Interac e-Transfers made through online or mobile banking. Keeping track of transactions. To Online Banking or the Mobile Banking App.

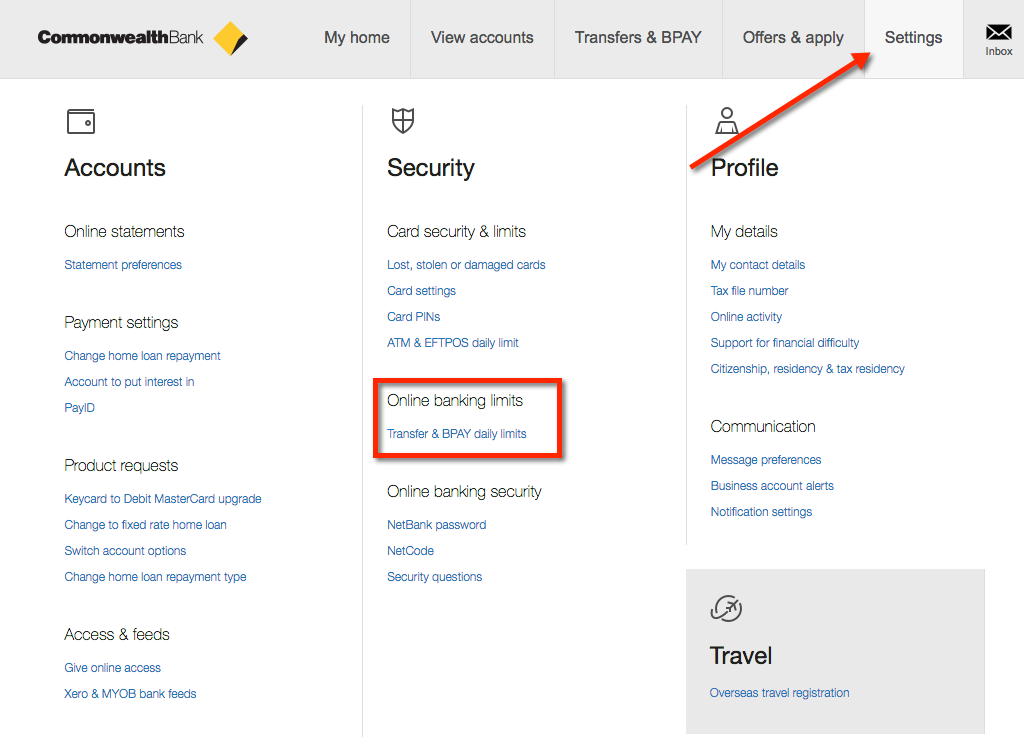

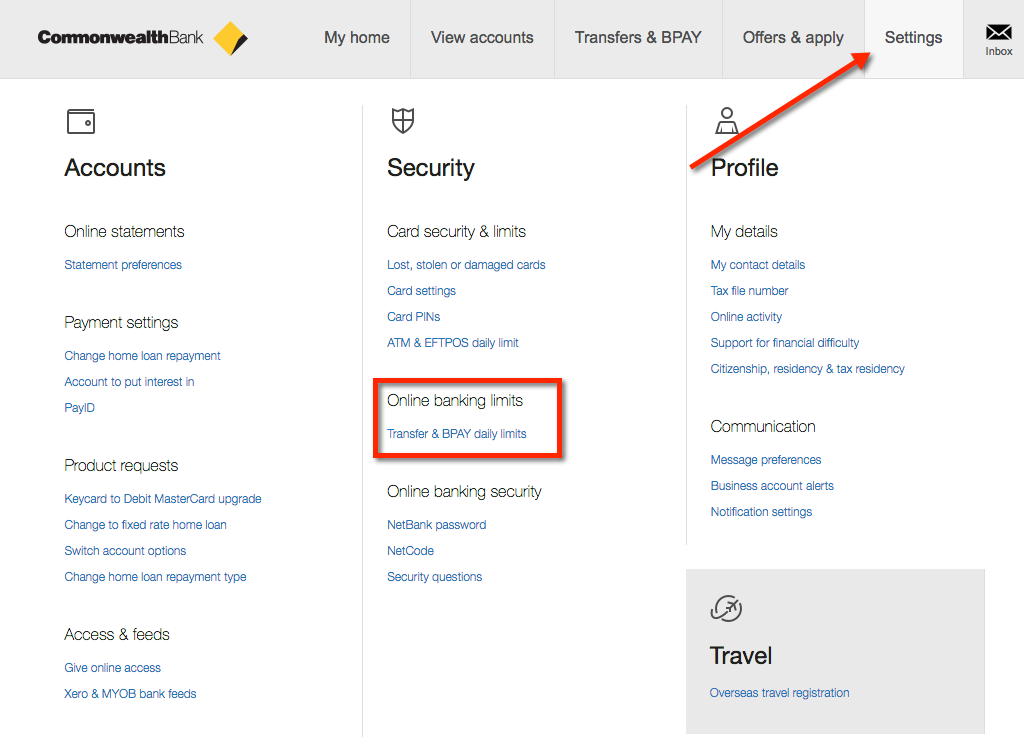

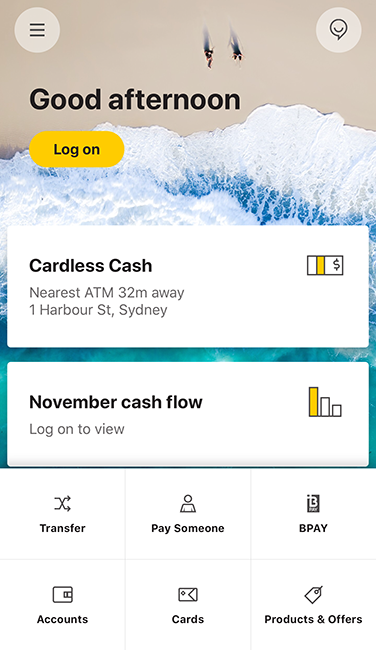

In the CommBank app open the app tap on the menu in the left hand corner and select Settings then Payment limits. Tap on Change card daily limit. Hi Jason there is no defined time requirement before you can apply to increase your limit.

1231 AM to 630 PM - Continue to enjoy your existing limits. Or follow the directions to add a new contact. This will bring your outstanding loan balance to 60000.

2 Step 2 Under Transfer Settings tap on Local Transfer Limit. To increase your limit please contact your bank. In the CommBank app.

How To Change OCBC Daily Transfer Limit. CBA allows you to increase your Netbank limit up to 1mday. A trusted name in the banking industry BofA has a long history of providing financial solutions for millions of customers.

If this is a new payee see How do I add a new Payee then come back to these steps. To increase your Third Party Transfer Limit just login to NetBanking and follow these simple steps. Click the Update my Daily Payment Limit button.

No PayID needed. To increase your limit please contact your bank. 1 Step 1 Log in to digibank Mobile with your Touch Face ID or digibank User ID PIN and tap More.

Oh thanks that wasnt mentioned anywhere on the website. To check the amount of money you can send each day. They are not doing the transfers for you just changing your internet banking settings.

3 Step 3 Tap on the transfer type you would like to change. You can increase your 2500 limit to 40000 by either opening the Profile Settings menu and selecting Internet Banking settings or by contacting Internet Banking Support on. If you have Suncorp Secured App you can choose to deactivate your Security Token via Suncorp Secured App or by contacting us on 13 11 55.

5 Step 5 Review your new daily limit and tap Change Daily Limit Now. From your Accounts page select Manage My Accounts. The default daily transfer limit for OCBC is 5000.

The daily limit for Osko transactions is included in the default Bank Australia daily limit which is 2000. However you can also change it to a lower value if you feel that it is too high. The default Daily Limit is 5000 per day but can be increased in Internet Banking with a Security Token Code.

Go to Profile and select Manage ScotiaCard. Click the payee you wish to increase. Go to Fastcash account setting ScotiaCard limits to see the electronic transfer limit for your account.

Open the app and tap on the menu in the left hand corner Select Settings security log on then select Payment limits. Cash Deposits Limit per 24 hours - 8000 Need more help. If you choose to deactivate your Security Token your daily limit will reset to default daily limit.

Click Transfers Payments from the left hand menu. 631 PM to 1130 PM - You can transfer up to Rs. Your changes will be updated immediately and youll get a message in your NetBank inbox confirming your limits have been updated.

If you go into a branch they can temporarily change your daily transfer limit to 100k. Direct Deposit Limit per 24 hours - 100000 Direct Deposit limits may be set lower by your financial institution. Below are the limits timings for NEFT transactions.

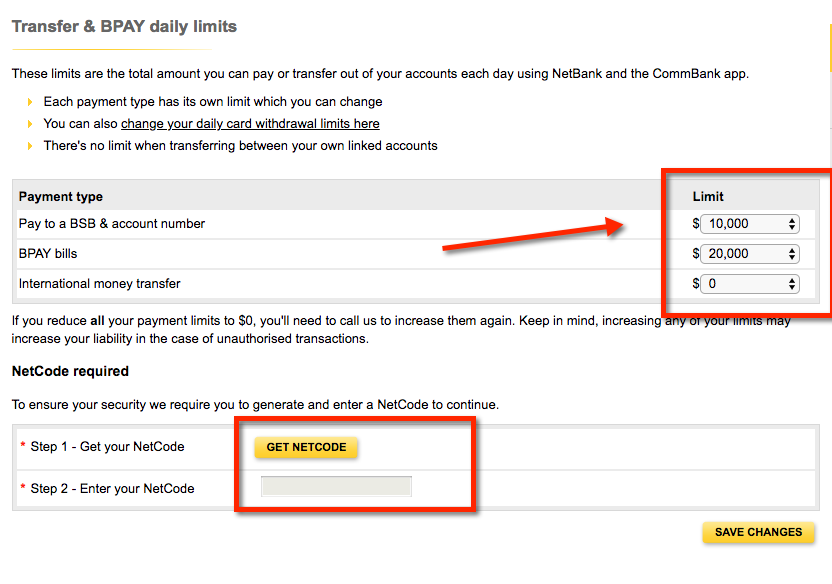

You can change your payment limits in NetBank and the CommBank app at any time. This will take you to the Send Money page. An international wire transfer is a secure reliable way to send money overseas.

You can also do instant transfer for 30 so you dont lose 1-2 days worth of interest. Navigate to Change card daily limit Card withdrawal spending limit. You can set a spending cap decrease your limit or apply for an increase in the CommBank app or NetBank.

How do I change my credit card limit. You can repay the loan in part or in full at any time by transferring funds directly from your RBC Business banking account to your RBC Visa CreditLine for Small Business through RBC Online Banking. With Osko you have the choice of using a BSB and account number or PayID to make and receive payments.

In NetBank Log on and go to Settings then Product requests and click on Credit card limit changes. Newly added beneficiary less than 24 hours old the limit is Rs 50000. Click Increase Payee Limit then Confirm.

Click on the Funds Transfer tab select Modify TPT Limit from the Request section click on INCREASE and chose your desired TPT limit from the drop down menu. Enter the required OTP Select a To Account from the drop down list if the To Account isnt an option you will need to Add a new Payee first Enter the Bill Payment details including Amount and Date. To see your limits in NetBank go to Settings.

Increase Cba Netbank Daily Limit Jewlz Ellem Tax Agent Xero Gold Partner

Posting Komentar untuk "How To Increase Transfer Limit Cba"