How To Get Ea Form Malaysia

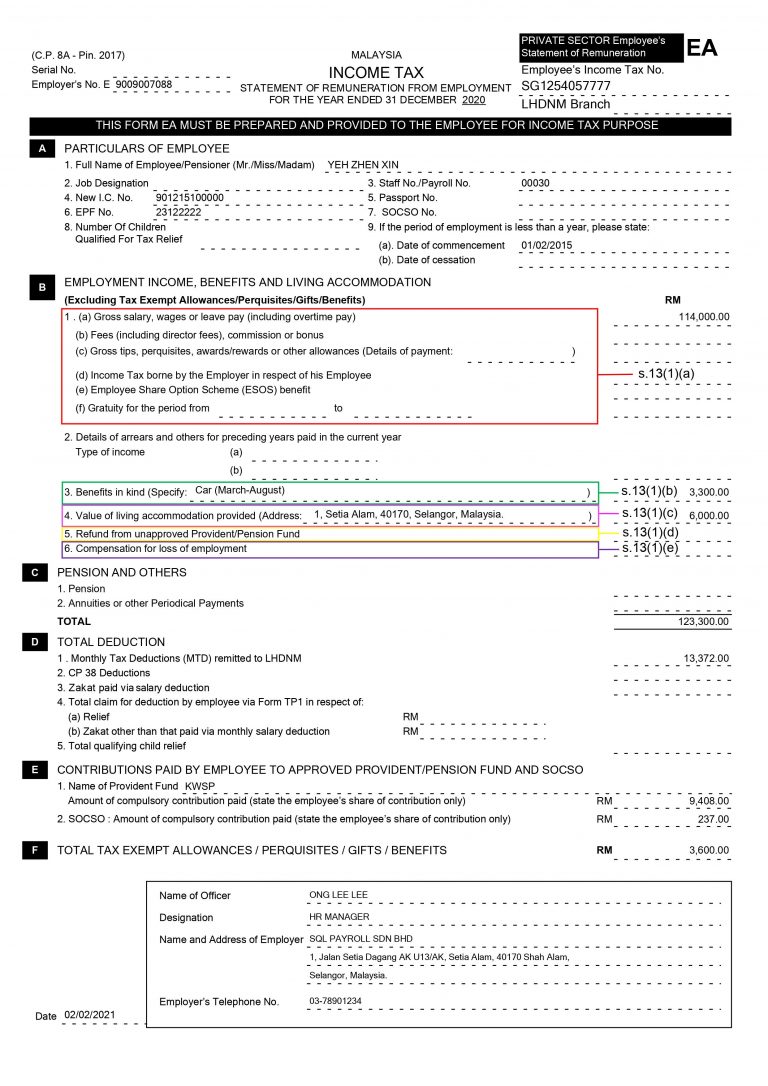

Any dormant company not in operation are also required to submit Form E. EA - Remuneration Statement for Private Employees.

How To Get An Ea Form What Is Ea Form Is Ea Form Compulsory

Both Form E and.

How to get ea form malaysia. Every time before the tax season comes around you will see everyone scrambling around the Human Resource teams office trying to get their own. The EA form has to be prepared by employers in Malaysia and given to the employees for income tax purposes. It is the Statement of Remuneration from Employment Private Sector.

We have located the specific links to make it easier to find the necessary forms and documentation. How do I get my EA form Malaysia. Either pickup from them or ask them send to another address.

Malaysia Code MY Q4. According to the Inland Revenue Board of Malaysia an EA form is a Yearly Remuneration Statement that includes your salary for the past year. Download Your Free Copy of EA Form Borang EA in Excel.

The EA form for Lembaga Hasil Dalam Negeri LHDN or the Inland Revenue Board Of Malaysia is also known as Form CP8A. Form E is a declaration report to inform the IRB on the number of employees and your employees income details. Form EA or EC is not required to be sent to IRBM.

E-Filing starts from 1st March to 30th April of every year. If you have a job or have been employed before you should have come across this little piece of paper called the EA form. Form E CP8D You may now send EA form to your colleagues by email or by print out the hardcopy.

In Part F of Form EA you could file for certain tax exemptions that can reduce your overall chargeable income. It is the obligation of employers in Malaysia to generate or prepare Form EA for employees e-Filing before March of every year. EC - Remuneration Statement for Government Employees.

How to generate EA form for your employees. How do I get the Country Code. Forms to be used.

At Statutory Income Total Income and Income of Preceding Years Not Declared information regarding payroll will be displayed. Generating Form EA in Swingvy takes a few clicks to get it out to your employees. What type of assessment should I fill in the item.

As long as Joe is exercising his employment in Malaysia his income regardless of the location of the payroll or bank account or employment contract would be regarded as derived from his employment with the company in Malaysia. In Swingvy payroll software you can choose either to send an email to your employees or download your employee EA form to print out hard copy. According to the Inland Revenue Board of Malaysia an EA Form Malaysia also refer to Borang EA EA Statement EA Employee is an Annual Remuneration Statement.

How e-File Income Tax Return Form Proceed back to ezHasil page and enter your Malaysian identification card number or international passport number and password under the Log Masuk Sign In box. Download EA Form Inland Revenue Board Of Malaysia. For Swingvy users.

The above mentioned form will be attached together with Form E which is posted to you. At Deductions Rebate Tax Deductions Tax Relief. Please note that there are 2 fields at the bottom of the EA Form for Name and Job Title of the employee who prepares the EA Form.

To prepare EA forms to print for employees e-Filing you can refer to the guide below or follow these steps. The Guidebook and Explanatory Notes can be downloaded from the IRBM website at wwwhasilgovmy. According to the Inland Revenue Board of Malaysia an EA form is a Yearly Remuneration Statement that includes your salary for the past year.

Print Form EA from Talenox. When the EA Forms are shared with employees they can download EA Form Excel format via Team Document Form Sharing in their Web Accounts. Please fill in accordingly.

Click on Bahasa Melayu link to display BE form in Bahasa Malaysia version. In accordance with subsection 83 1A of the Income Tax Act 1967 ITA 1967 the Form CP8A. It is compulsory under Msia Law that companies must finish preparing EA form to employees before 31st Jan whether you are employed changed job changed country emigrated changed life died etc.

It is mandatory to submit Form E regardless whether you have employees or not. Hence the employer would need to report the income in the Form EA and Form E. Watch the video below for a quick guided walkthrough to get your Form EA in less than a minute.

In Part F of Form EA you could file for certain tax exemptions that can reduce your overall chargeable income. LHDN will open the actual Form E submission CP8D at 1 Mar 2021 it should be very straightforward and work exactly like last year. Exempted from submitting Form CP8D.

This form can be downloaded and submitted to Lembaga Hasil Dalam Negeri Malaysia In pdf format. According to the Inland Revenue Board of Malaysia an EA form is a Yearly Remuneration Statement that includes your salary for the past year. In Part F of Form EA you could file for certain tax exemptions that can reduce your overall chargeable income.

In case if you do not receive it Form EAEC can be downloaded here. My status is single. C Failure to prepare and render Form EA EC to employees on or before 28 February 2021 is an offence under paragraph 1201b of ITA 1967.

How do I get EA form from LHDN. B Failure to furnish Form E on or before 31 March 2021 is an offence under paragraph 1201b of the Income Tax Act 1967 ITA 1967. Do it in Feb so they can have their tax assessment in March.

Videos you watch may be added to the TVs watch history and influence. If you export EA Form as HRmy Administrator these 2 fields will be left empty. Head over to Payroll Payroll Settings EA.

If playback doesnt begin shortly try restarting your device. To prepare EA forms to print for employees e-Filing you can refer to the guide. Tax Payer Deceased Persons Estate List under Administrator e-Filing should be attach with form CP55E if there is more than one Deceased Persons Estate to.

The Country Code is available in the Form BE Guidebook or Form BE Explanatory Notes. User Manual e-Form ezHASiL version 33 User Manual e-Form ezHASiL version 33 10 5. What is EA form in Malaysia.

EA Form and CP8D forms are available in both English and Malay versions but the Excel versions are only available in English.

Lhdn Borang Ea Ea Form Malaysia Complete Guidelines

Ea Form 2020 2019 And E Form Cp8d Guide And Download

Form St Partners Plt Chartered Accountants Malaysia Facebook

Confluence Mobile Community Wiki

Posting Komentar untuk "How To Get Ea Form Malaysia"