How Long To Wait Before Increasing Credit Limit

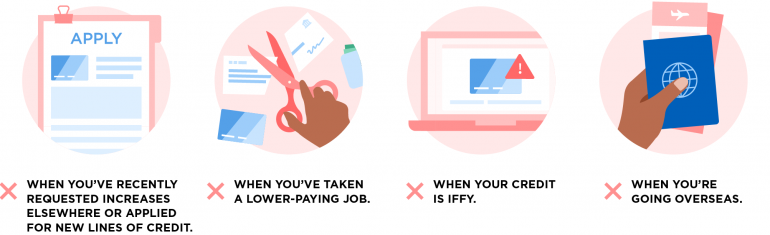

When you have good credit. You can ask for a credit limit increase as many times as youd like but the more often you ask the less likely you are to get your increase approved.

How To Increase Credit Limit It S Easier Than You Think

Either youll be instantly approved or youll have to ask for a manual review.

How long to wait before increasing credit limit. Call us on 1300 651 089. For BusinessChoice Everyday or BusinessChoice Rewards Platinum credit cards download the. How soon can I increase a credit limit increase.

I asked after 6 months and got it increased to 350. 17 January 2013 at 1211AM. If you have good credit scores 670 to 739 or excellent credit scores 740 and greater that.

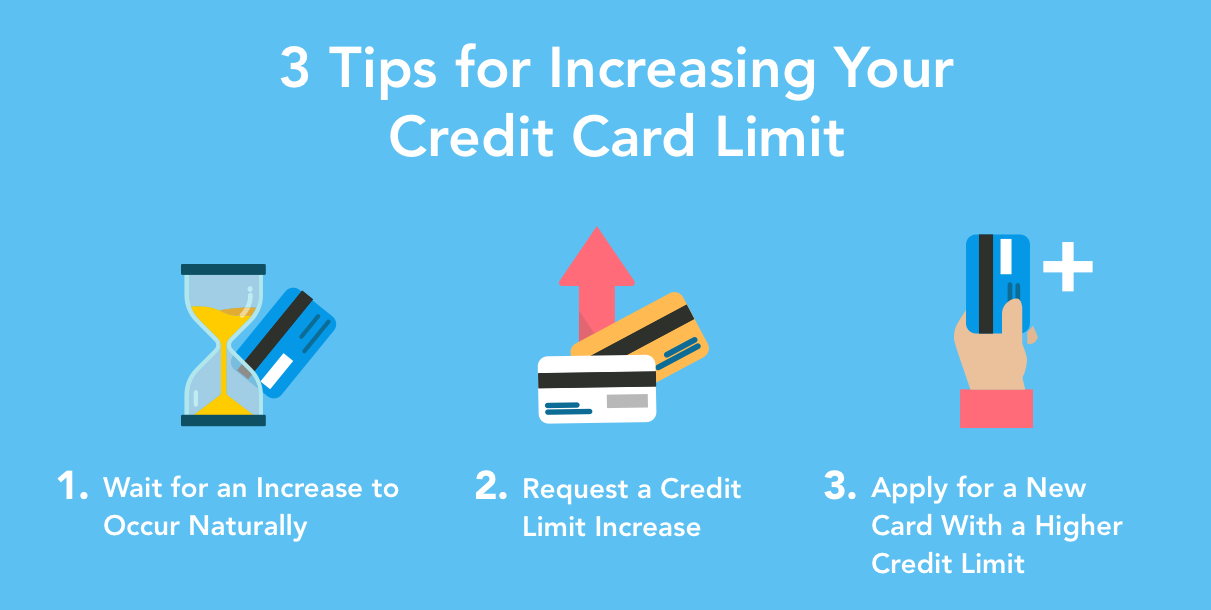

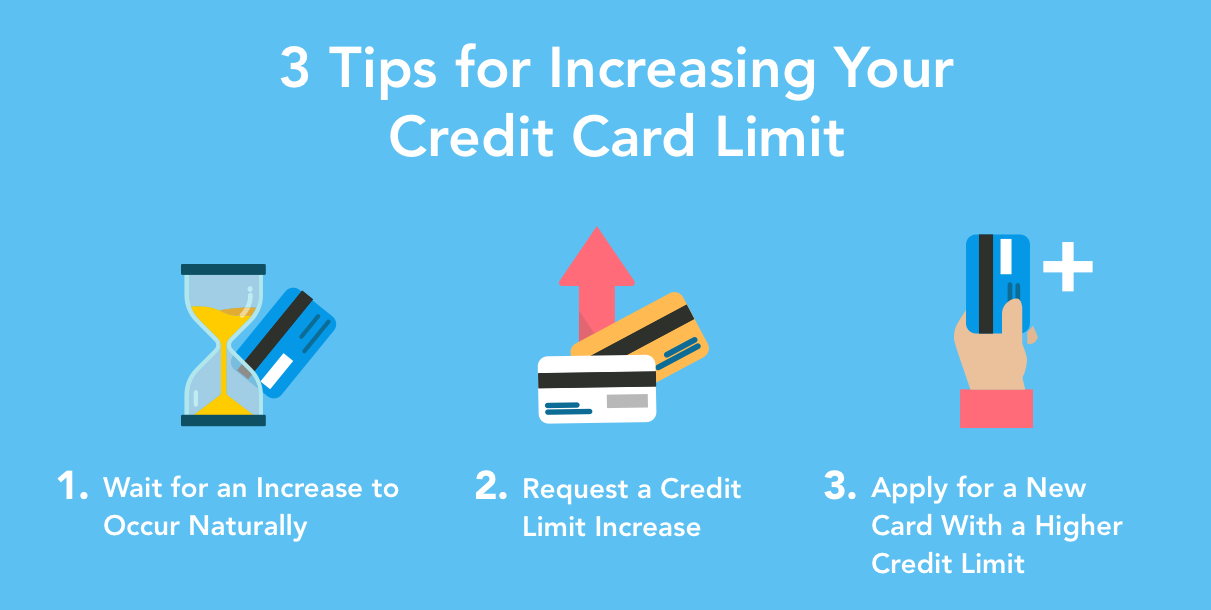

You may be eligible for a credit limit increase without asking after 6-12 consecutive months of on-time bill payments with a new credit card account. Waiting a few months between requests could help improve your chances. The experience in the aqua reward thread is that of quite a few members having the limit doubled from 250 to 500 after 6 months.

Online Banking customers can sign in and request a credit limit increase. You can request to change your credit limit in the following ways. Generally its best to wait at least six months before asking for a credit limit increase.

Keep working on your score and make sure your credit card balances are as low as you can get them before asking again. 1 Log in your Citibank account. Under those conditions your request for a higher.

24 views View upvotes Answer requested by Jason Trimble. If you are requesting. 2 On the menu bar go to Manage My Account Credit Line Increase Request.

Whether you request a credit limit increase online or over the phone you may receive a response in as little as 30 seconds or you may need to wait up to 30 days. Oct 14th 2012 102 am. You can request a credit limit increase once your account has been opened for at least 60 days.

Even better if your card issuer uses the adjusted-balance method for calculating your finance charges making a payment right before your statement closing date can save you money. If you can show even a small increase in income that helps a lot for limit increases. Asking sooner than that could be a red flag to your creditor and you could be turned down.

If youve made all of your payments on time and never maxed out your card youre more likely to get approved for a limit increase. Most card issuers automatically review credit limits after six months. Here are some of the best times to ask for a credit limit increase.

That will give you time to build up a good payment history and demonstrate to the credit card company that youre responsible. I got a USD Visa card from RBC a couple of weeks ago but Id like to have a larger credit limit. This will be bad for your credit.

Credit card issuers may review your credit file and account every six to 12 months and may offer you a credit line increase when they do. As a rule of thumb its best to keep your credit utilization ratio below 30. Credit card companies need evidence that you can handle your current spending limit responsibly before giving you the ability to borrow more.

Less than 30 of your credit limits is good. There are some reports of people having to wait 90 days now so you might need to wait a little longer if you want to be safe. Most credit card companies recommend a 6 month wait before re-applying for an increase.

599 or better for a 60 month term. Even if you dont ask for an increase Chase may give you one automatically. Know how much youre willing to pay per month and get the lowest financing rate possible eg.

If you demonstrate that youre a responsible credit card user and use the card enough to warrant a credit limit increase you could get a higher credit line as frequently as every 6 or 12 months. 3 After that youll get one of two screens. Visit your nearest branch.

Your credit score has recently increased. Go ahead and call a backdoor number and ask for a CLI. Open loans are good because you can pay back more or earlier without penalty.

If you want to request a credit limit increase with Discover you can call the number on the back of your rewards credit card or log into your online account or Discover app. If youve ever logged into your card account or opened your cards app and seen a pop-up screen requesting income information it could mean your card issuer is considering a credit limit increase. You can increase your odds of getting an automatic credit limit increase by.

Most others who asked seemed to get similar. Youve had your account for at least three to six months and used it responsibly. Similar to a credit card application some requests will be approved quickly by the issuers algorithms while others will require more information or review by a human.

Generally you should wait at least 3 months after your acount is open to ask for a CLI. How much of my credit limit should I use. This includes making on-time payments and paying your balanceall while using the card frequently1 In fact showing youre a responsible card user can lead to a credit card limit increase as often as once every six to 12 months.

Sometimes You Have to Ask If you havent received an automatic increase it doesnt mean youre not eligible. You havent applied for any other new credit lines in the past three to 12 months. Less than 15 is even better 10 is great You dont need to wait X amount of days after applying for a mortgage or a card to increase your chances of getting approved for something else.

How long to wait before asking for credit limit increase. Financing rates may also increase on loan terms greater than 5 years60 months so be aware. Lower utilization is good for your credit score especially if your payment prevents the utilization from getting close to or exceeding 30 of your total credit limit.

And later requests should be no more often then 3 months apart How often they review your account likely depends on the account you have if its starter card its probably only once a year.

How To Increase Credit Limit It S Easier Than You Think

3 Easy Tips How To Increase Credit Card Limit Mintlife Blog

When Should I Ask For A Credit Limit Increase Nerdwallet

Why And How To Request A Credit Limit Increase Money Under 30

Posting Komentar untuk "How Long To Wait Before Increasing Credit Limit"