Is It Possible To Increase Credit Card Limit

I accidently paid over the limit so the card had 10000 in it. If youve used the card regularly kept on top of repayments and not maxed it out you may be able to get the limit increased after 6 months or so.

How To Increase Credit Limit It S Easier Than You Think

When your bank or credit card company increases your credit limit it simply means theyve upped the amount of money you can borrow from your credit card.

Is it possible to increase credit card limit. Prior to making the purchase contact your credit card company and ask for an increase in your credit limit. If the max card limit shows higher than your current limit then you are eligible for limit increase Like Reply Quote InvestPotato about a year ago Expand myliferockkss wrote. A credit card issuer is more likely to increase your credit limit if you maintain or improve your credit score.

For example if you have an American Express card you can request a credit limit increase once your account has been open for at least 60 days. There are two main ways to request a temporary or permanent limit increase on any Citi credit card. If you are using it responsibly and making the payments on time the Credit issuer may consider to increase the previous limit assigned to the credit account.

You will probably be asked to fill out a new application like the one you completed when you opened the credit card account. Getting a credit line increase can actually benefit your credit utilization ratio. Just log into your account and head to the customer service section to ask for an increase.

Follow the on screen instructions to complete your request. One of the biggest benefits of a credit limit increase is that it can have an instant positive impact on your credit. If you demonstrate that youre a responsible credit card user and use the card enough to warrant a credit limit increase you could get a higher credit line as frequently as every 6 or 12 months.

And if you have a Capital One card you generally arent eligible for a credit line increase if you opened your account within the past several months. Credit card companies need evidence that you can handle your current spending limit responsibly before giving you the ability to borrow more. When you apply for a credit card youre given a certain spending limit based on your income and creditworthiness.

A credit limit increase can help improve your credit score. Increasing your credit limits is a good way to blunt the effect credit card debt can have on your credit scores. Indicate on the form the new credit limit you want.

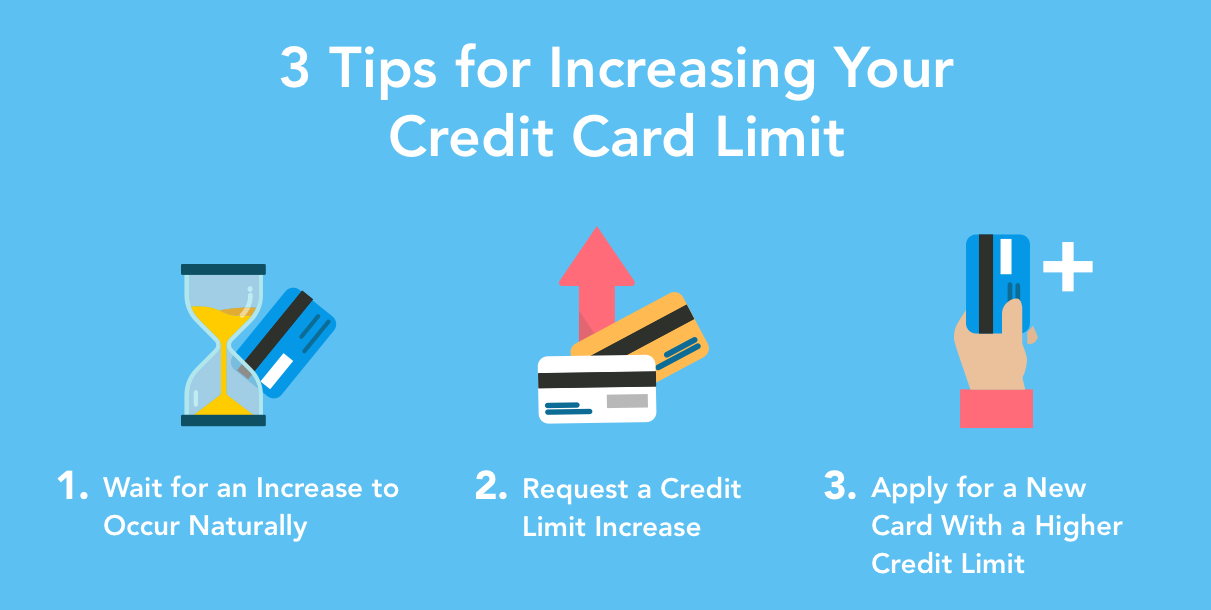

Debt Management Consumers trying to improve their credit scores are often advised to increase the credit limit on their credit cards. The Credit Limit is increased periodically on the basis of customers usages behaviour of the credit account. There are four ways to increase your credit limit on a credit card.

The answer is yes it may. While some credit card issuers automatically increase your credit limit others will only raise your limit if you ask. Some banks make the decision instantly.

Lets go through them. A key factor in. 2 Wait for your credit card company to automatically raise your credit limit.

Many credit card companies increase your credit limit automatically without you having to lift a finger. If you increased your credit cards limit from 1000 to 2000 and left your 600 balance. Whether its a credit card a Credit line or a bajaj finserv type card.

There is no guarantee that they will grant the increase either. Alternatively select your AIB Credit Card in Accounts and click on the Account Management and select Request Limit Increase. If the max card limit shows higher than your current limit then you are eligible for limit increase Got it I am not eligible then for me it shows 0 KG Like Reply Quote.

Spending more than 30 of your available credit can affect your score even if you pay off your balance every month. Requesting a rise If you feel like you might need some more credit perhaps to make a large purchase or go on holiday you might want to request a higher credit limit. With that said you cannot transfer credit lines from one card to another with Citi.

So I do think its possible to increase your credit limit that way. Is it recommended to increase my credit limit. Get a credit limit increase before you need one.

Some credit card issuers allow you to request a credit limit increase online. Personally Im not at all comfortable using even 25 of my credit lines and certainly not more than 25 on one card. 3 Add to a secured credit cards security deposit.

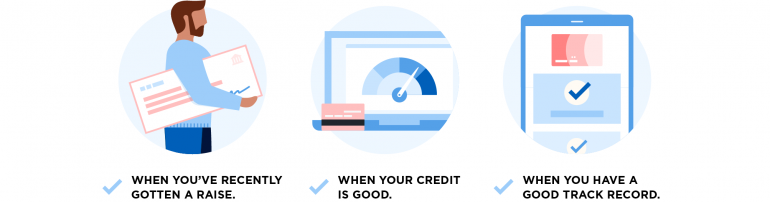

1 Request a higher limit from your credit cards issuer. Ive tried many times requesting for a credit limit increase. You may be eligible for a credit limit increase without asking after 6-12 consecutive months of on-time bill payments with a new credit card account.

To start the process call the toll-free number either posted on the back of your card or on your monthly bill and listen to the promptsthere may be a prompt for requesting a credit limit increase. After six months to a year of timely payments and low revolving debt you may be. An increased credit limit will lower your credit utilization ratio which in turn improves your credit score.

And if you ever are able to place a large purchase --say a car-- on the card to gain cash back you have the unused credit to do so. Choose the relevant card and click on Request Limit Increase. What are the benefits of a credit line increase.

Click on Manage my Cards. How to request a limit increase for a Citi credit card. Too many hard inquiries into your CIBIL score can hurt your credit score.

I was denied many times. You have to call and ask for a credit limit decrease on one card and a credit limit increase on the other. However this is only possible if you do not exhaust the increased credit limit all at once.

I left it that way for a month. This incurs a hard pull because you are asking for more credit on one of your cards. An expanded credit limit lets you use your credit card to make larger purchases finance more necessities weather more emergenciesall without causing your credit utilization to climb too high.

In some cases it may massively increase your score. For instance consider the example from above. My credit limit turned into 100.

I had a macys card which only had 7500 credit limit. Requesting an increase in a line of credit limit may trigger a hard enquiry into your credit report This means that your lender will scrutinise your credit worthiness by re-evaluating your CIBIL score. And 4 Apply for a new credit.

Simply call 1-888-248-4226 for the banks customer service. Increasing your credit limit immediately decreases your utilization says Sullivan. If you become unemployed or require credit urgently you may find it challenging to get approved.

3 Easy Tips How To Increase Credit Card Limit Mintlife Blog

When Should I Ask For A Credit Limit Increase Nerdwallet

How To Increase Credit Limit It S Easier Than You Think

How To Increase Credit Limit It S Easier Than You Think

Posting Komentar untuk "Is It Possible To Increase Credit Card Limit"