How To Apply Sme Loan Maybank

To apply simply complete the EFS Application Form PDF and SME Banking Consent Form PDF and send them in with the required documents. For Financing Application enquiries please contact.

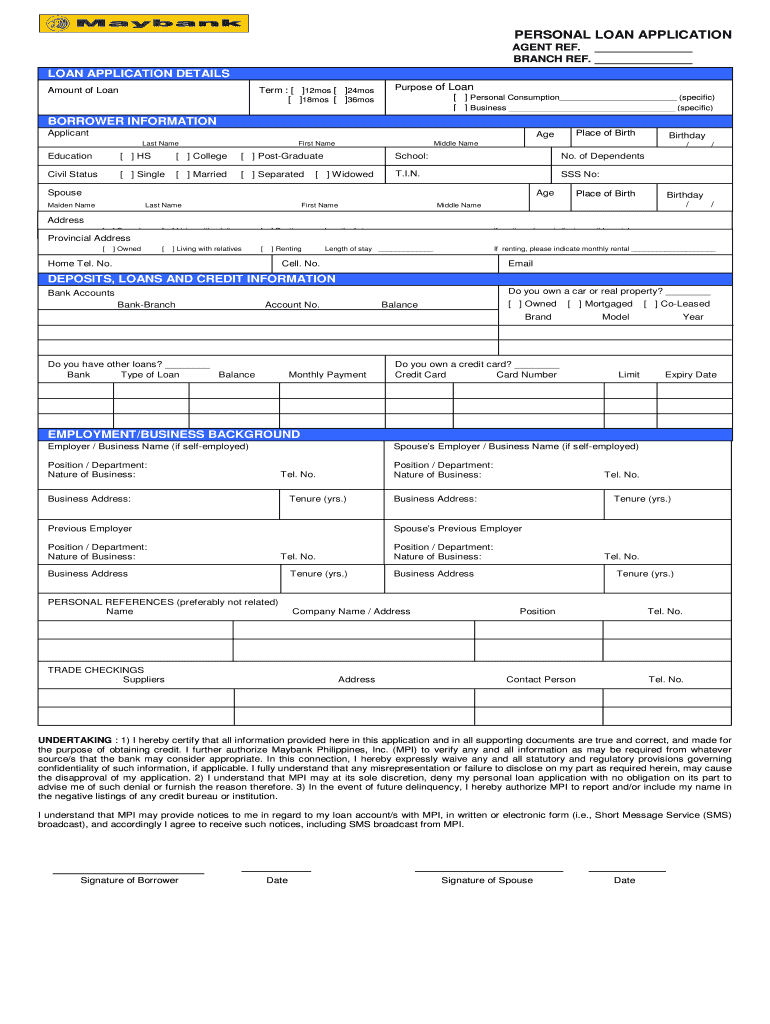

Maybank Loan Application Form Fill Online Printable Fillable Blank Pdffiller

The worst time to seek financing is when you need it the most.

How to apply sme loan maybank. When youre ready click Apply to complete your free application today. As this is an unsecured personal loan you dont need to standby a guarantor or collateral. Receive up to S388 cashback when you apply for a Maybank CreditAble Account and Maybank CreditAble Term Loan with a minimum approved loan amount of S12000.

Through Maybanks SME Digital Financing SMEs can apply for financing online via Maybank2u or Maybank2uBiz anytime anywhere without having to visit a branch. From micro loans to term loans and more. SME Clean Loan Financing i Boost your companys working capital with fast Cash and no collateral required.

To be eligible to receive S150 worth of eCapitaVouchers under the Campaign applicant must during the Campaign Period successfully apply for a Renovation Loan via the SingPass online loan application platform on Maybanks website with a minimum loan quantum of S15000 and a minimum loan tenure of 3 years Loan. Receive application status as fast as 10 minutes. Download fill up the Application Form and send it to the nearest SME Bank branch.

03 2283 2019. This email address is being protected from spambots. What documents do I need to prepare for Maybank Personal Loan application.

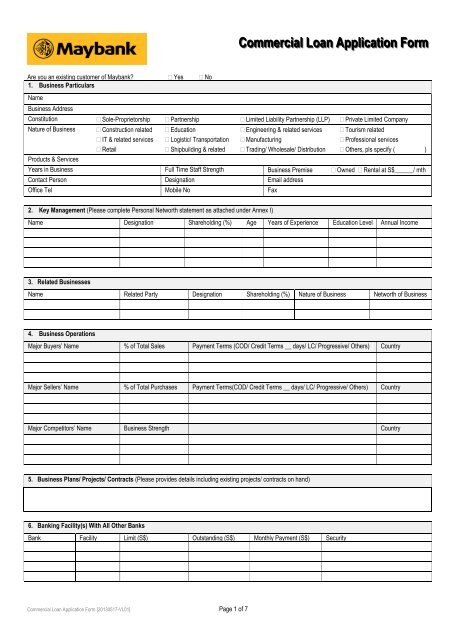

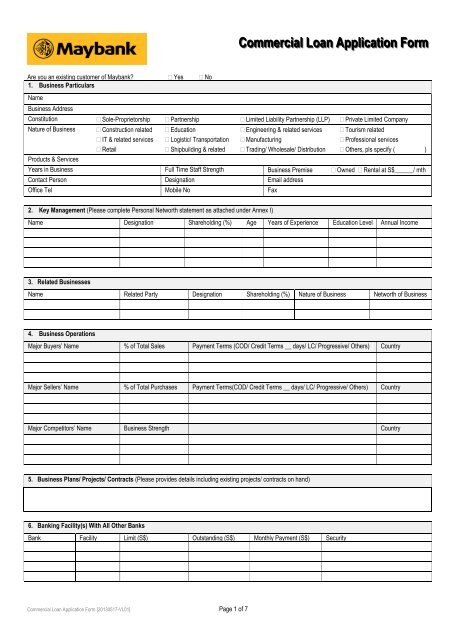

Maybank offers the Business First Loan a groundbreaking initiative by Maybank to support newly incorporated startups. Maybank also requires applicants to complete a hire purchase agreement form if applicable. Increase your net working capital with an SME loan from Malaysias top commercial banks and development financial institutions.

Apply online now Apply online and get financing up to RM250000 within minutes. Already a Maybank SME or Business Banking customer. Receive application status as fast as 10 minutes.

It allows businesses who are starting to grow to obtain working capital for cashflow or for business expansion. Step 2 Receive call from our friendly business loan consultant. Maybank SME Micro Loan.

Together with the application form you will be asked to provide following supporting documents. Locate our branch here. We offer SME Loans in Singapore to help small local enterprises and start-ups gain easy access to financing with competitive business loans interest rates.

Promotion valid till 31 January 2022. Customise your business finance plan and improve your business credit rating with on-time low interest loan repayments. Sole Proprietor Partnership Private Ltd Company.

Video from Mr Chong Ka Foo. Registered SME businesses with turnover below RM25 million including non-Maybank customers are eligible. Many of these applications will regrettably be declined by banks.

Get the Lowest Small Business Loans rates in Malaysia. Photocopy of NRICPassport Computerised payslip. The best time to apply for SME financing is when you can prove that you dont need it.

Let us help you get the lowest monthly repayments. Minimum 1 year with Maybank. SME Clean Loan Financing i Boost your companys working capital with fast Cash and no collateral required.

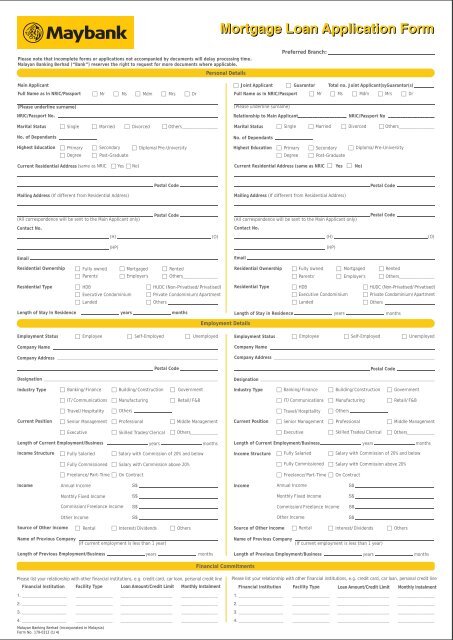

Individuals interested in applying for Maybanks car loans must complete an application form and provide documents proving their identity income and employment. To prove ones income salaried applicants must submit either their latest computerised payslip last 6 months CPF Statement of Account or their latest Income Tax Notice of Assessment. There is no early repayment penalty so.

Business in operations for minimum 3 years. Repayment payment period up to 5 years. If your browser is unable support display of the form please click download and open the file with Adobe Acrobat Reader installed on.

Available for online application to both Maybank and non-Maybank customers. The Maybank Micro Loan provides for loans up to S100000 with a tenure of 4 years. Login Maybank2u using your existing ID or login Maybank2uBiz using your Maker ID to fill in application form under Apply Online.

Terms and Conditions apply. Financing amount from RM20000 up to RM250000. Unfortunately Many SME owners will only start sourcing for financing when they face a cash flow crunch.

Apply Online Now Apply online and get financing up to RM250000 within minutes. Examples of Required Documents. Domestic Toll Free 1800-10-588-3888.

Latest 1-month salary slip OR. Make the best decision for your needs with our small business loan calculator and rate comparison tool. Step 1 Find the best business loan with our comparison table then leave your detail by clicking the Apply button of your preferred loan.

The Maybank Micro Loan is a joint initiative by the Singapore Government and Maybank. How do you apply for a business loan online. Copy of NRIC front and back AND.

They will help you to answer your questions and submit your application to bank. Submit your application online now in 3 simple steps. Available for online application to both Maybank and non-Maybank customers.

To apply for Maybanks renovation loan borrowers must submit an application form as well as proof of identity income renovation and home ownership. Eligibility for online application. New businesses that are not able to obtain financing because they do not meet the mandatory incorporation length can apply for the Business First Loan.

How do I apply.

Maybank How To Apply For Maybank Sme Digital Financing New Maybank Customer Facebook

Mortgage Loan Application Form Pdf Maybank

Commercial Loan Application Form Pdf Maybank

Maybank Can Approve Sme Loan Applications Within 10 Minutes On Maybank2u And Maybank2u Biz Soyacincau

Posting Komentar untuk "How To Apply Sme Loan Maybank"