How Often Should I Increase My Credit Card Limit

If you plan to call or chat online with customer service be sure to prepare yourself with. Open the Wallet app on your device and tap Apple Card.

But is this always a good idea.

/how-credit-limits-are-determined-32cdb9b1d6784f30b386aee414e94270.jpg)

How often should i increase my credit card limit. Heres how to request a credit limit increase with the Apple Card step-by-step. Try to time your credit limit increase request so its more likely to get approved. You can ask for a credit limit increase as many times as youd like but the more often you ask the less likely you are to get your increase approved.

Since banks consider credit score while setting Credit Card limits its better to ensure that you have a good score. After six months to a year of timely payments and low revolving debt you may be able to request an increase of your credit limit. Does anyone know if I can request an even higher credit limit right out the gate and would they still go off that report as its only about 30 days old if that.

After that request a. How often will Barclaycard increase my credit limit. Should I Pay Down My Balance Before Requesting a Credit Card Limit Increase.

Use your credit card regularly. This ratio is simply the total amount of credit you used compared to your current credit limit. You may not need to pay down your whole balance before requesting an increase but you may want your current credit card utilization to be below the recommended 35-40.

In the US at least if you charge a lot eg. But theres more to credit limits. Credit card companies need evidence that you can handle your current spending limit responsibly before giving you the ability to borrow more.

If you use your card regularly and pay your bills in full and on time the bank will automatically increase the credit limit on your card. Send a message requesting a. Tap the More Options icon.

Cardholders are generally eligible for Amazon Store Card credit limit increases after 6 months of on-time payments but that doesnt mean you will necessarily be granted one. As soon as you receive and activate your credit card you can request a credit limit increase. Tap the Message icon.

In most cases this should be completed within 1 business day. For example if you have an American Express card you can request a credit limit increase once your account has been open for at least 60 days. I love the card and have already swiped it many times.

And if you have a Capital One card you generally arent eligible for a credit line increase if you opened your account within the past several months. We will notify you by SMS once your document is verified and you can continue your Limit Increase application. My score is 798.

I was instantly approved for their Platinum Rewards Visa Signature Card with a limit of 20K. The amount of your credit line will be listed on your credit card statement. Up to close to your credit limit for two or three months in a row and pay it off in full each month your credt card company will raise your credit limit all by itself to prevent you from accepting an offer from a competing credit card.

How many times can you ask for a credit limit increase. If you were approved for a credit limit increase you can try to request another increase six months later but note that getting approved for a second credit limit increase is often more difficult the second time around. This is often the key to deciding whether an issuer will accept a new card application.

A prudent borrowers credit utilization rate should be less than about 40 percent. But note that often banks dont approve you for a credit limit increase until after youve used their cards for several months. If you have two credit cards and each has a limit of 5000 its better to have 1000 in charges on each card than 2000 in charges on one card.

This will allow you to start a chat with a Goldman Sachs representative. Your credit card issuer might increase your credit limit in the future when the timing is right. Improve your credit score.

If youve had a substantial rise in your income then youll probably stand a much better chance of having success. At this point where granted I have very established credit when I get a new card itll have a 5k limit and I call after 6 months and ask for 20k and generally get it. Or grant a request for a credit limit increase.

Should I increase my credit limit if offered. So I personally would wait 3 to 6 months before requesting a credit limit increase from the time of opening a new credit card account or from the time of my last credit limit increase. You can increase your odds of getting an automatic credit limit increase by.

Waiting a few months between requests could help improve your chances. By increasing your available credit and maintaining similar monthly costs you are essentially decreasing your credit utilization ratio which can improve your credit score. I would wait at least 6 month after opening a new cardyour last credit increase.

You need to wait at least six months before you request your first credit limit increase. A Mobile contact number. Your credit limit is the maximum amount you can charge on your credit card.

You may be eligible for a credit limit increase without asking after 6-12 consecutive months of on-time bill payments with a new credit card account. Credit card issuers may review your credit file and account every six to 12 months and may offer you a credit line increase when they do. Look at this DTI.

If the credit limit on your credit card is not as high as youd like you may want to request a credit line increase. If it is offered chances are your credit wasnt accessed in a way that will hurt you and an increase will help your utilization score. To upload your PPSN documentation for verification.

Id like 30K or 40K. If you demonstrate that youre a responsible credit card user and use the card enough to warrant a credit limit increase you could get a higher credit line as frequently as every 6 or 12 months. That said theres no reason to ask for 2k increments.

For example lets assume that you started with a credit limit of 1000 and regularly have 800 charged onto the cardthat means your credit utilization is at 80. If youve ever logged into your card account or opened your cards app and seen a pop-up screen requesting income information it could mean your card issuer is considering a credit limit increase.

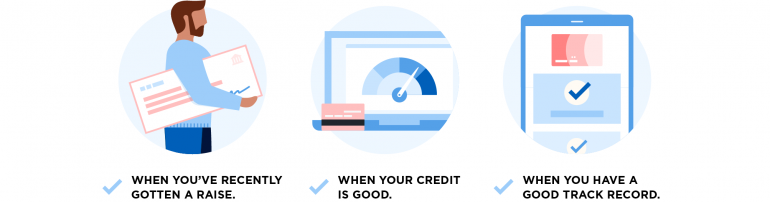

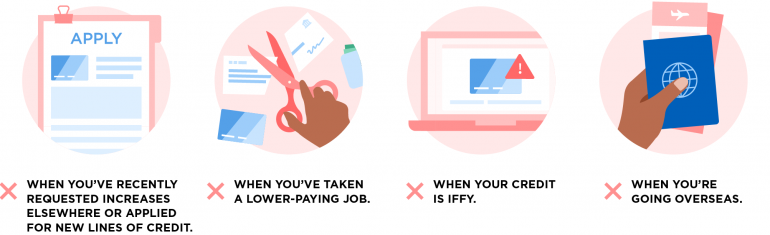

When Should I Ask For A Credit Limit Increase Nerdwallet

When Should I Ask For A Credit Limit Increase Nerdwallet

/how-credit-limits-are-determined-32cdb9b1d6784f30b386aee414e94270.jpg)

How Your Credit Limit Is Determined

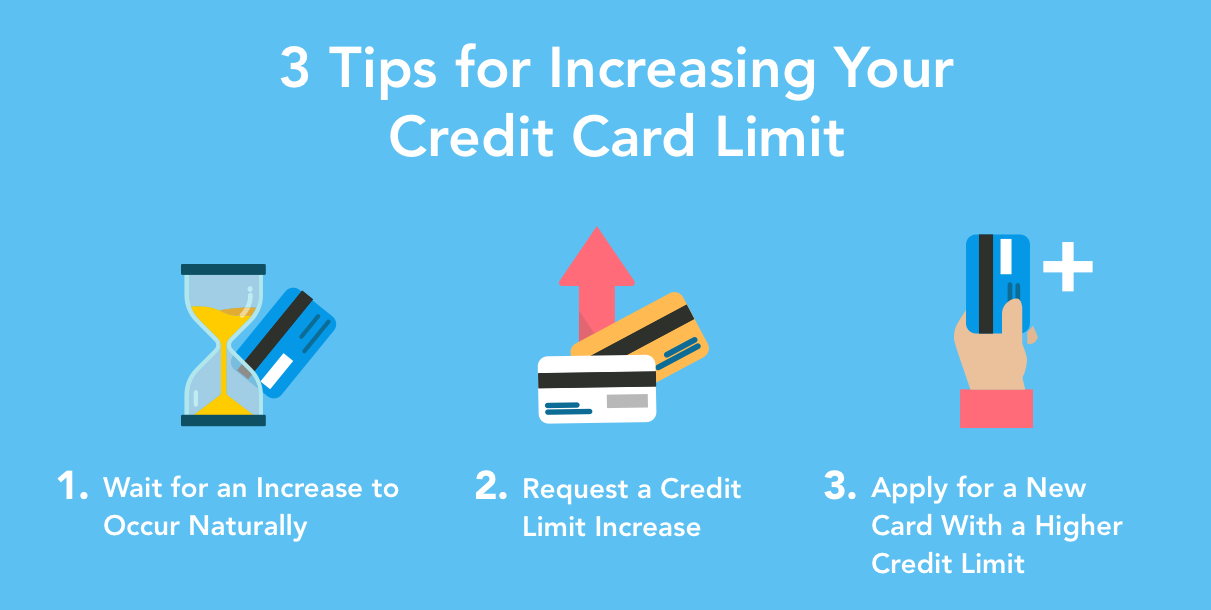

3 Easy Tips How To Increase Credit Card Limit Mintlife Blog

/credit-limit-definition-960695-v1-82b65d7e2653423cb55f871b05a0ccf1.png)

Posting Komentar untuk "How Often Should I Increase My Credit Card Limit"