How Long Between Credit Limit Increases

If your lender is not willing to increase your credit limit proceed with caution. That said theres no reason to ask for 2k increments.

3 Easy Tips How To Increase Credit Card Limit Mintlife Blog

You can request a credit limit increase once your account has been opened for at least 60 days.

How long between credit limit increases. That is a 15 utilization rate. This can usually be done either by phone or via the internet. How soon can I increase a credit limit increase.

If all goes well Discover will grant your request for a credit limit boost. Wells Fargo does not have predetermined time period you must have your account open to qualify for a credit limit increase. 6 months for CLI with cap one.

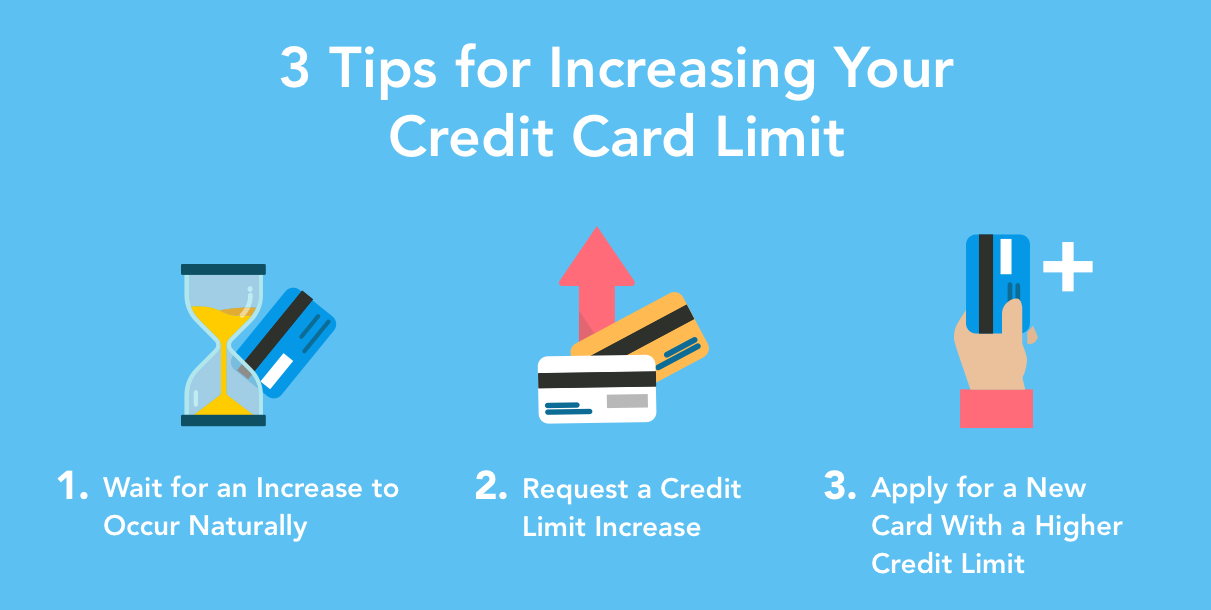

At this point where granted I have very established credit when I get a new card itll have a 5k limit and I call after 6 months and ask for 20k and generally get it. However you can try as many times as you like as it is a soft pull on your CR. Either you wait for the bank to automatically raise your credit limit or you apply for a credit limit increase through the banks customer service representative.

To raise your chances of being approved for a higher credit limit pay your bill on time for at least six straight months reduce your outstanding debt and update the income Credit One has on file. If youve ever logged into your card account or opened your cards app and seen a pop-up screen requesting income information it could mean your card issuer is considering a credit limit increase. You would see an instant 10 percentage point reduction in credit utilization which would help your credit score.

Whether you request a credit limit increase online or over the phone you may receive a response in as little as 30 seconds or you may need to wait up to 30 days. Many card issuers require you to wait at least three months after account opening before requesting a credit limit increase. Wells Fargo gives you the option to increase your credit card limit by either making a general increase request which increases.

How to Increase Credit Limit in the Philippines. I would wait at least 6 month after opening a new cardyour last credit increase. AMEX PRG NPSLLowes 17000Capital One venture card 12000Us Airways mastercard 9500Fidelity Amex 9000 Discover it 8000 Capital One Venture One 7500 BOA 123 rewards 7500 CSP 6000 Capital One Quicksliver 5500 Amazon Store.

The strategy of asking upfront can backfire and eventually become the reason behind the dip in your credit score. If you could increase your credit limit by 3000 on each card you would have a 1500 balance with 10000 in limits. Before you request a credit limit increase.

1 There are two ways to get a higher credit card limit in the Philippines. You can ask for a credit limit increase as many times as youd like but the more often you ask the less likely you are to get your increase approved. Similar to a credit card application some requests will be approved quickly by the issuers algorithms while others will require more information or review by a human.

If you demonstrate that youre a responsible credit card user and use the card enough to warrant a credit limit increase you could get a higher credit line as frequently as every 6 or 12 months. How to increase your credit limit without hurting your score As noted earlier most lenders have a mechanism for asking for an increase. New accounts must wait 60 days to request a credit limit increase.

The reason why a reque. Credit card issuers may review your credit file and account every six to 12 months and may offer you a credit line increase when they do. How much of my credit limit should I use.

So I personally would wait 3 to 6 months before requesting a credit limit increase from the time of opening a new credit card account or from the time of my last credit limit increase request. New accounts must typically wait a minimum of six months to request a higher credit line. Dos and donts once you get your credit limit increase.

Waiting a few months between requests could help improve your chances. Many credit card companies increase your credit limit automatically without you having to lift a finger. But note that often banks dont approve you for a credit limit increase until after youve used their cards for several months.

So plan well before you request for a higher credit limit. Sometimes You Have to Ask If you havent received an automatic increase it doesnt mean youre not eligible. Existing accounts typically need to wait three to six months between requests.

However six months is a good starting point for having enough of a positive history. When you just opened the card or requested a credit limit increase. DPs that Ive read from reddit community for Apple Card state that its reccommended that you wait at least 90 days since the date you last received a CLI If it is your first CLI first CLI since being approved I dont believe there is any definite rule on how often and how early you can request for one but most of the time you will get.

If you request a credit limit increase you will be asked to give Navy Federal permission to do a hard pull of your credit report. Wondering how to increase your credit limit. Credit Limit Increase Waiting Periods.

Log into your Wells Fargo online banking account for your credit card and go to the Manage Credit Limit tab. There are some reports of people having to wait 90 days now so you might need to wait a little longer if you want to be safe. As a rule of thumb its best to keep your credit utilization ratio below 30.

Credit limit refers to the maximum amount of credit a financial institution extends to a client. This includes making on-time payments and paying your balanceall while using the card frequently1 In fact showing youre a responsible card user can lead to a credit card limit increase as often as once every six to 12 months. If youve received a credit limit increase or a credit limit.

Credit One will be more likely to increase your credit limit if the revised income clearly shows that you can afford a higher limit. Theres usually no set timeframe to wait after requesting a credit line increase and every issuer will have their own criteria for how frequently they will approve credit. You should also wait a minimum of 3 months in between future credit limit increase requests.

You can request a credit limit increase CLI directly from Wells Fargo by phone or online. Capital One lets you request a credit limit increase online as often as you want but you can only be approved once every six months. Answer 1 of 9.

Call Wells Fargo customer service at 1-800-642-4720.

When Should I Ask For A Credit Limit Increase Nerdwallet

How To Increase Credit Limit It S Easier Than You Think

Why And How To Request A Credit Limit Increase Money Under 30

How To Increase Credit Limit It S Easier Than You Think

Posting Komentar untuk "How Long Between Credit Limit Increases"