How Much Should I Increase My Credit Limit

You may not need to pay down your whole balance before requesting an increase but you may want your current credit card utilization to be below the recommended 35-40. For example your credit limit was increased from 2000 to 4000 and you have a 1750 balance on that account.

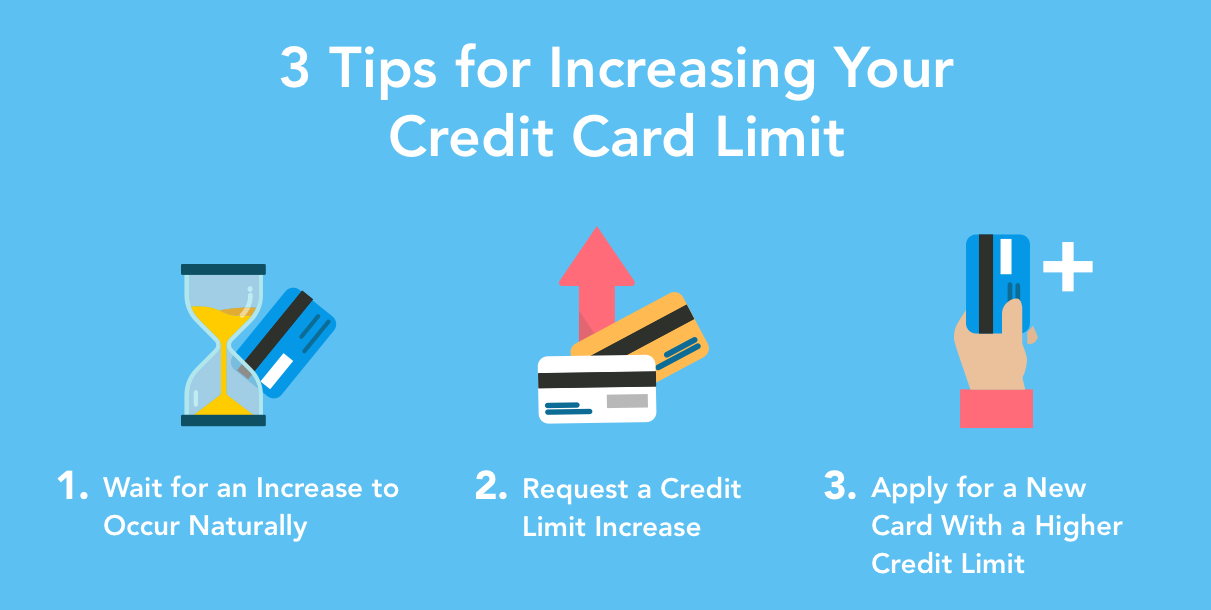

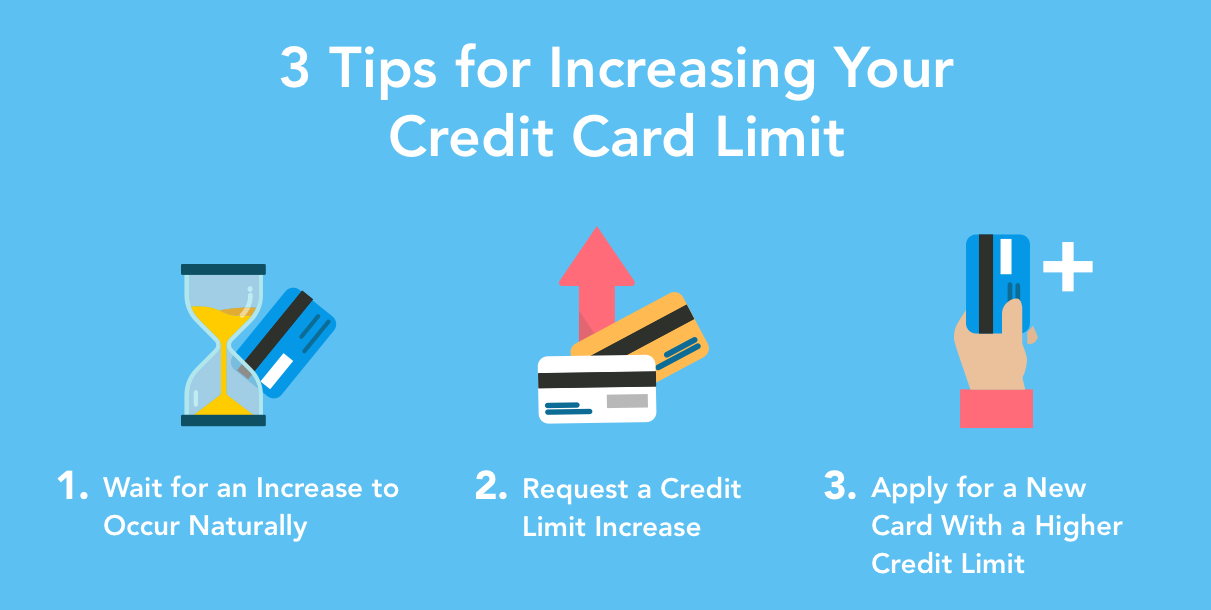

3 Easy Tips How To Increase Credit Card Limit Mintlife Blog

Instead ask for 10 to 25 more up to y 1000 in credit you already have.

How much should i increase my credit limit. Log in to your account. You can ask for a credit limit increase as many times as youd like but the more often you ask the less likely you are to get your increase approved. An increase in income means youll be able to cover an increase in credit card expenses.

For example you should be able to get a 10 to 25 percent increase on your credit limit so long as your finances can support it but a doubling of your credit limit is extremely unlikely barring rare. How much should I ask for credit limit increase. Which Card to Choose Its time to figure out which credit card you should choose to request a credit limit increase on assuming you have more than one.

Larger credit limit increases on the other hand will likely require a hard inquiry on your credit report. Citi should be soft and do it right online. If you increased your credit cards limit from 1000 to 2000 and left your 600 balance untouched your utilization would drop from 60 to.

How much should I ask for Chase is HP and if you can take the HP I would call directly into backdoor and try to do it with Rep while on phone if they have any questions. There are multiple aspects to consider when deciding how much of a credit limit increase to request. Keeping it to 10 or lower is even better.

How to Increase Your Credit Limit. For example youll generally want to keep your credit utilization between 20 and 30 of your available credit. If your limit increased to 4000 your utilization ratio would drop to 25.

By increasing your credit limit you can decrease your ratio without even making any extra payments on your current debt. If you are at 6k 12-15k would be where I would be asking. One factor to consider is that the representative may only be able to increase your credit limit a small amount based only on your account history.

At the same time you dont want to ask for too much or seem too confident. Youll be told how much you qualify for in a few seconds. You may need to provide proof of your new income to get approved for a higher credit limit.

If you have excellent or even good credit you may be able to ask for more. With such a low credit limit you may have to pay the card off several times a. The average credit card limit in the UK is between 3000 and 4000 though the limit you get will very much depend on your income and credit history.

If youd like to call in to check on the status of your credit limit increase you can call 800-567-1083 or 866-314-0237. As a result you should make sure to ask for smaller credit limit increases. Previously your credit utilization was about 88 1750 2000 88.

Personally Im not at all comfortable using even 25 of my credit lines and certainly not more than 25 on one card Having more credit doesnt hurt you unless you use it irresponsibly. Credit unions vary a lot when it comes to handling credit increase requests. For example if you currently have a 5000 limit and a 3000 balance you may want to reduce the balance to 1740 35 before asking for an increase.

Its usually pretty reasonable to request for your credit limit to be increased by 50 to 100 depending on how high your starting credit limit is. So if you have a credit limit of 10000 and a balance of 3500 your credit utilization is 35. The worst that would likely happen is when applying for a mortgage or other line of credit a bank may ask you to lower or close a large line.

If youd like a card with a higher limit I suggest applying for a Chase or Amex card. There are reports of people starting with credit limits at 1200 and then receiving increases all they way up to 20000. You should use the card regularly for everyday purchases and pay the balance in full when you get the statement or when your balance reaches about 250.

For example dont insist the rep double your credit limit. However you can request for increases that are way higher than that. If it is offered chances are your credit wasnt accessed in a way that will hurt you and an increase will help your utilization score.

Answer 1 of 11. This often means that you will be denied your requested credit limit increase but not always. Should I increase my credit limit if offered.

Theres no one-size-fits-all answer to how much of a credit limit increase you should request. Keeping your credit utilization under 30 helps prevent credit card balances from bringing down your score. Raising your credit limit decreases your utilization ratio if your balances remain the same.

After requesting your credit limit increase you might receive a 7 to 10 day message. There are two ways to lower this ratio paying down. If you dont have a lot of available credit on your credit cards it can be difficult to keep a low credit utilization rate.

Waiting a few months between requests could help improve your chances. Without adding more debt your new limit decreases your utilization rate to roughly 44 1750 4000 44 which may help your credit score. If the bank cant approve you for limit that high usually theyll counter and you might end up at 5000.

If youre offered a higher limit youll have the option to either accept it or request a larger amount. If you increase your spending and max out the card at the new limit then your credit utilization ratio will go right back up and affect your score negatively. Select Card Services and then Credit Limit Increase Provide the required financial information such as income and hit next.

First you can request a credit line. How much of my credit limit should I use. Some are generous with extending credit some are not.

Fortunately there are a couple of ways you can increase your credit limit. If youve a lower income andor a poor credit history youre likely to get limits starting around 200 with a maximum of 1500. As a rule of thumb its best to keep your credit utilization ratio below 30.

How To Increase Credit Limit It S Easier Than You Think

/how-credit-limits-are-determined-32cdb9b1d6784f30b386aee414e94270.jpg)

How Your Credit Limit Is Determined

What Credit Limit Will I Get When I Apply For A Credit Card

/credit-limit-definition-960695-v1-82b65d7e2653423cb55f871b05a0ccf1.png)

Posting Komentar untuk "How Much Should I Increase My Credit Limit"