How Much Can I Increase My Credit Card Limit

This is because youve proved that you can handle your current limit and may be likely to manage a. Raising your credit limit decreases your utilization ratio if your balances remain the same.

What Credit Limit Will I Get When I Apply For A Credit Card

Everyone is considered for credit limit increases automatically on a regular basis.

/credit-limit-definition-960695-v1-82b65d7e2653423cb55f871b05a0ccf1.png)

How much can i increase my credit card limit. Instead ask for 10 to 25 more up to y 1000 in credit you already have. How much can I increase my credit card limit by. Will I be charged a fee if I use my TD Bank debit card at a non-TD ATM in the US.

Be prudent when requesting a credit card limit increase. Very Good 725-760 Welcome bonus. The average credit card limit in the UK is between 3000 and 4000 though the limit you get will very much depend on your income and credit history.

Making a payment towards your Petal account will reduce your Current Balance and make more credit available. Can having no credit hurt you how much can i increase credit limit does a capital one credit card help your credit score. Credit utilization works something like this.

You cant get more than one Best Buy credit limit increase per six months. If you spend more and go over your credit limit youre likely to face a 12 charge for doing so. After several months of responsible borrowing you might find that you could be offered a higher limit - you could be eligible for up to 2 limit increases year.

How to cut pine cones. Increasing your credit limit can be a helpful move after youve started earning more money as your finances will have more flexibility. What Happens After Getting a Credit Card Limit Increase.

One factor to consider is that the representative may only be able to increase your credit limit a small amount based only on your account history. How much should I ask for credit limit increase. At a glance.

How can I request a credit limit increase on my credit card. For 6 months reverts to 1399 pa. Now if you made payment of INR 50000 your total available credit limit will be INR 125000.

Please contact TD Card Services at 1-888-561-8861. The amount by which you can increase your credit limit depends on your income expenses credit score and any existing debts. If you have a 1000 credit card balance on a card with a 2000 credit limit your credit utilization ratio for that account is 50.

If you have a similar card forego requesting a credit limit increase and instead move to a better credit card as soon as you qualify. There are two main ways to request a temporary or permanent limit increase on any Citi credit card. What is the difference between Visa Debit Card purchases and credit card purchases.

Benefits and drawbacks to requesting a credit card limit increase. Can we overpay our credit card to increase limit. See more articles in category.

In Australia financial regulations require credit card companies to gauge whether you can repay the increased credit limit within three years. 0 annual fee for the first year 55 pa. This no fee card gives you the benefits of a higher fee card including a great cash back rate no limit to the amount you can earn and many other great AMEX perks.

If you add a new card with a 10000 limit and a zero balance your available credit increases to 20000 and your utilization drops to 25 percent. Any amount you deposit above whats required will boost your spending limit by the same amount. Min credit limit.

See Example 1 But suppose you immediately make a big purchase with the new card perhaps because it has a generous rewards sign-up bonus or an introductory no-interest period. The money you spend reduces your Available Credit. For one the First Premier Bankcard charges 25 of the increase each time youre approved for a credit limit increase.

For example if youre required to place a 49 deposit and you put down 149 your credit limit will be 300 instead of 200. You could receive an automatic limit increase when Citi reviews your file every six months. How to request a limit increase for a Citi credit card.

This works unitll payments and transactions are settled. You can purchase every day up to your limit which may be in smaller quantities. Photo by Natee MeepianEyeEmGetty Images There are multiple aspects to consider when deciding how much of a credit limit increase to request.

What does the driving test consist of. According to a recent report by Experian the 2020 average credit limit for Americans across all credit cards was 30365. How much of a credit limit increase should you ask for.

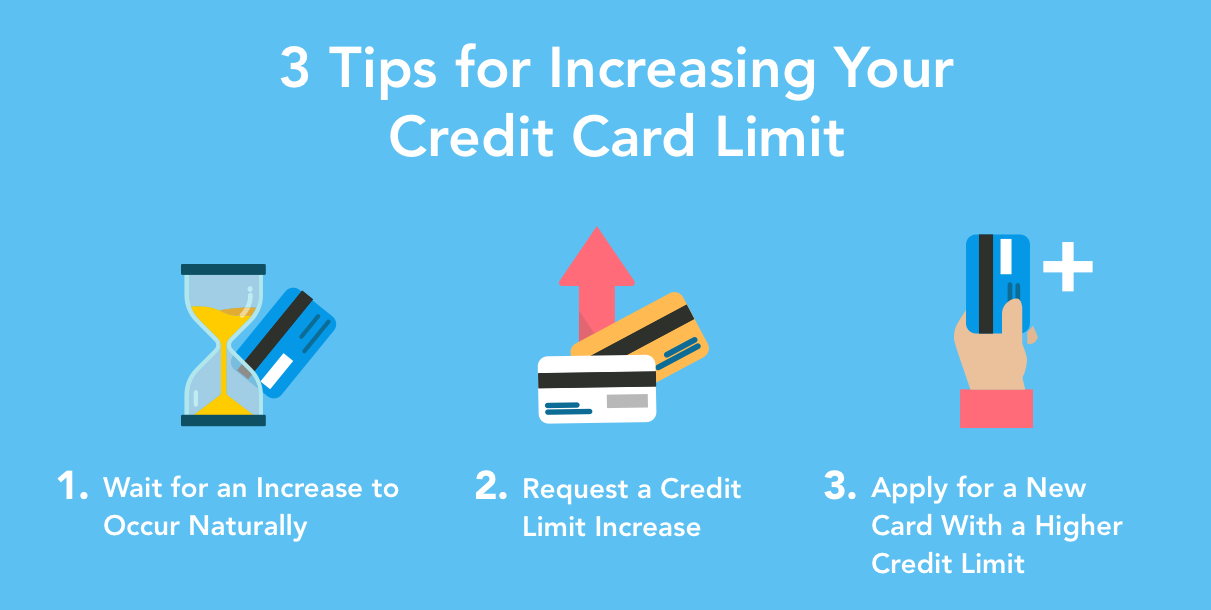

Theres no one-size-fits-all answer to how much of a credit limit increase you should request. You can ask for a 10 to 25 increaseanything higher than that can be seen as a red flag. For example dont insist the rep double your credit limit.

At the same time you dont want to ask for too much or seem too confident. Larger credit limit increases on the other hand will likely require a hard inquiry on your credit report. Lets go through them.

If your limit increased to 4000 your utilization ratio would drop to 25. This is the maximum amount the lender is prepared to lend you on this card. If youre denied you can apply again without waiting.

But unless your circumstances have changed it probably wont work. You can immediately make a request with your card issuer. Waiting for increases is one of the slowest ways for your limit to be increased but also requires very little information on your part.

Get a 0. You can also find this in the Settings tab of your Petal account and on your monthly statement. For example youll generally want to keep your credit utilization between 20 and 30 of your available credit.

Pay on time for 6 months. Maybe you are interested. A larger credit line may allow for more flexibility when it comes to your spending power but this isnt always a good thing.

Credit cards are issued with credit limits or maximums that dictate how much a cardholder can spend on the card before needing to pay the cards balance. Limits may increase per week or after a 3-month period depending on your account level. Say your total credit limit is INR 100000 and your due is INR 25000.

Simply call 1-888-248-4226 for the banks customer service. If you have excellent or even good credit you may be able to ask for more. 4 Its worth noting that this card caters to people with bad credit.

3 Easy Tips How To Increase Credit Card Limit Mintlife Blog

The Average Credit Limit On A First Credit Card

How To Increase Credit Limit It S Easier Than You Think

Posting Komentar untuk "How Much Can I Increase My Credit Card Limit"